Selling your business involves a range of steps. It doesn’t really matter

There are many ways to calculate how much your business is worth and many factors to consider when determining its sale price.

whether you are using a broker or selling it yourself, you need to be aware of what is involved so you can take all the factors into consideration and get the best price for your hard work.

After all no-one knows your business like you do. In most cases it’s the knowledge in your head that has to be communicated to a potential buyer so they can understand the potential of the opportunity.

Here are some hints and tips to help get you started.

Valuing your business

There are a variety of methods which can be used to value your business. You should take into account a range of factors, including:-

- Annual profit;

- Goodwill;

- Plant, machinery, fixtures, fittings and other assets included in the sale;

- Intellectual property values;

- Stock / inventory;

- Database / client lists;

- Growth opportunities and potential;

- Current market drivers.

You may wish to get an experienced professional business valuer on board to assist you in reaching a suitable selling price.

Promotion and advertising when selling your business

Various media outlets can be used for promoting and advertising of your business. Online business sale sites are one very popular method of advertising your business for sale, and these can be organised independently or through a broker.

You should take time in preparing a promotional summary of your business, which includes a description of the business, it’s history and any potential growth or expansion opportunities which can be capitalised on by a prospective purchaser.

Preparing a summary of the financials

Your potential purchaser will be interested in seeing the financials for your business. At the start of the sales process, you should prepare a summary of financial information that can be made available for review by potential purchasers.

![]() Don’t hand out your financial details without first screening interested parties, and weeding out the sticky beaks, tyre kickers or sneaky competitors.

Don’t hand out your financial details without first screening interested parties, and weeding out the sticky beaks, tyre kickers or sneaky competitors.

Only once you have verified the identity of the interested party, and the sincerity of their request, should you consider releasing any sensitive information.

Using a Confidentiality Agreement before releasing any information

Potential purchaser’s will want to access information that in usual circumstances, is kept strictly confidential and is highly sensitive. This includes the financials, business methods, trade secrets and other sensitive information.

Of course, this information should not be made available to anyone and everyone.

If the screening and identifying of the potential purchaser has checked out, you should insist that the interested party sign a confidentiality agreement before handing over any information.

You can customise a confidentiality agreement to suit your own particular circumstances, but as a minimum it should:-

- prohibit the individual from using the information in any way, other than to evaluate the possibility of purchasing the business;

- prohibit the individual from using the information to compete with you;

- require the individual to return the information to you, or destroy the information, in the event they decide not to proceed with the purchase;

- prohibit the individual from copying the information or divulging it to third parties.

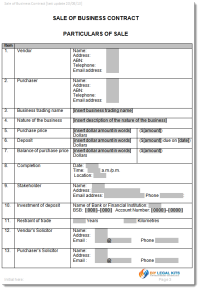

Preparing the business sale agreement

A Sale of Business Agreement solidifies your arrangement in writing and offers protection to both parties

Once you have found a purchaser, signing a Business Sale Contract will secure the deal.

The contract may be made conditional upon certain events occurring, such as:-

- the purchaser obtaining finance approval;

- the landlord approving of the transfer of the lease of the business premises to the purchaser;

- a set due diligence period; or

- other conditions as negotiated between the parties.

The business sale contract is crucial in binding the parties to the agreed terms. The terms and conditions may include:-

- any pre-conditions to the purchase;

- the purchase price;

- the date the balance of the purchase price will be handed over (completion date);

- identification of the stock, goodwill, fixtures, fittings, plant, machinery;

- staffing arrangements;

- intellectual property;

- restraint of trade;

- guarantee;

- any contracts or leases concerning the business that need to be transferred to the name of the purchaser, for example, premises lease, equipment leases or hire contracts.

Plant, machinery, goodwill and other assets

You will need to identify the plant, machinery, goodwill, stock and other assets that will form part of the business sale agreement and, if necessary, arrange for the transfer of these assets into the name of the purchaser. You should ensure that these items have clear title. If they are secured as part of finance arrangements, you should ensure that clear title is obtained prior to the completion date.

If the business uses equipment under an equipment hire agreement, or has other licences, rentals or hire agreements in place, the contracts will either need to be cancelled or transferred to the name of the purchaser as of the purchase date.

Identifying intellectual property

In an increasingly digital age, intellectual property is more and more valuable. Don’t overlook its importance and make sure it is transferred to the new owner correctly.

Intellectual property is any valuable creative property that is the product of the mind. These assets are not physical as such, but are still valuable.

IP includes things such as:-

- logos;

- trademarks;

- registered business methods or systems;

- patents;

- formulas;

- software coding;

- copyright material.

You will need to identify any IP that is being sold with the business and where necessary, arrange for it to be transferred into the purchaser’s name (for example, registered trademarks).

Non-compete (restraint of trade) agreement

It is likely the purchaser will want assurance that you will not compete with the business you have sold them, by setting up a competing business and trading in the vicinity. Goodwill is an important component in the sale of an existing business. By not competing, the purchaser’s can take full advantage of the goodwill and existing database of customers that you have sold them as part of the existing business.

In a non-compete or restraint of trade agreement you agree not to compete within a certain area, for a certain amount of time after the business sale.

Transferring the premises lease

If you rent the business premises you will need to transfer the lease to the buyer. You will need to seek your Landlords permission in writing.

If you don’t want to remain liable under the lease once the new owner has taken over (and trust us, you don’t), you will need to have the lease transferred into the name of the purchaser. This is sometimes referred to as an assignment of the lease: you being the assignor, and the purchaser, being the assignee (or party that the lease is being assigned to).

Ideally, the transfer documentation should be arranged before the business sale is completed and the transfer documents should be made available to the purchaser on the completion of the sale (settlement date).

Transferring your rights and obligations as tenant under a lease, to someone else, means that you will no longer be accountable under the lease, from the date of the transfer (which will be the date the business sale is finalised).

Before you are able to transfer the lease, you will need to obtain the landlords consent to the purchaser, as the new tenant.

You will need to ask for the landlord’s consent in writing. They may in turn request supporting documentation such as references, details of prior business experience and information as to the financial viability of the tenant, to help them assess whether the purchaser would be a suitable tenant.

If the landlord agrees to the purchaser’s taking over the lease, you will need to arrange for a formal Transfer of Lease document (assignment) to be completed and signed. In this document, the purchaser agrees to replace you on the lease and ensures that you will no longer be liable under the lease from the date of the business sale.

Vendor’s terms (financing the purchase)

Sometimes, a vendor agrees to finance part of the purchase. This may be, for example, if the purchaser is unable to obtain finance through other sources. Usually, this means that the purchase price is paid in instalments by the purchaser, over a period of time. This is referred to as ‘Selling the Business on Vendor’s Terms‘. In this event, the vendor will retain ownership of the business, and the assets of the business, until the purchase price is paid in full.

If you are selling your business on vendor terms, you should ensure the necessary provisions are contained in your Business Sale Agreement, to protect your interests. See here for further information on sale of business on vendor’s terms.

Reviewing personal affairs and asset structures

Exiting your business is an ideal time to review your personal asset holdings and structures, which may be intermingled with your company or business affairs. You may need to restructure how your assets are held, review trust structures, and update your Will.

Sale of business kit

Our Sale of Business Contract Template Kit will save you thousands of dollars in legal fees

The sale of business kit contains a range of documents pertinent to selling your business, including:-

- Sale of business agreement;

- Sale of business user’s guide;

- Confidentiality (non-disclosure) agreement;

- Restraint of trade;

- Transfer (assignment) of lease;

- Loan agreement;

- Sublease agreement;

- Commercial property lease;

- Consultancy agreement;