Call Us -

1800 608 088

A Financial Separation Agreement is a contract you can make with your spouse if you are separating from a marriage or de facto relationship.

Correctly known as a Binding Financial Agreement (BFA), these documents are provided under the Family Law Act as an alternative to fighting things out in the Australian court system. As long as both parties agree, you can use a financial separation agreement to divide your assets and liabilities without the need for protected legal proceeding.

The agreement must specify a complete list of all joint and individually owned assets and liabilities which is called the property pool.

A well drafted document will clearly set out how the property pool will be divided including for example the transfer of assets such as real estate, superannuation, shares or motor vehicles. It will include clauses that deal with any spousal maintenance payments and how to divide property the couple have decided to sell.

Your separation agreement will also include a list pertinent facts, known as recitals, that give the reader of the document an understanding of how you reached your agreement. Recitals will include certain facts such as each party’s income, whether the parties receive Centrelink benefits or the names and dates of birth of any children.

It’s worth noting that your BFA cannot deal with children’s matters such as payments for child support or arrangements for shared parenting or custody.

A DIY Separation Agreement is one that you and your ex-partner draft yourself before seeking legal advice. Many couples have realised it’s not necessary or a requirement to have a lawyer draft the agreement, particularly if your arrangements are quite simple. You just need access to a professionally drafted separation agreement template and the guidance of a company that has helped thousands of couples separate their finances before.

It’s worth noting, if you choose to start with a DIY Separation Agreement each party still needs to get professional advice from an Australian legal practitioner before signing the document, this will ensure the agreement binds the couple and has legal force in case of any disputes.

Having your lawyers draft a Separation Agreement can be a costly affair. Your typical Australian family law practitioner bills between 350-700 dollars per hour. Between initial meetings, the inventory of assets and liabilities, the decision-making process, and communicating between parties, an individual can pay tens of thousands of dollars before a draft is complete.

Legal firms generally use templates as a starting point to draft any contract. The template provides a framework which includes standard provisions and topics that must be covered, prompting the drafter to ask particular questions. Most law firms will have a library of document templates they have used many times before, because using a template speeds up the process, saving time and money. Why reinvent the wheel when you don’t have to, right?

Purchasing a template and a legal review package from RP Emery can produce the same legally-binding financial agreement saving the couple literally many thousand of dollars. You will be able to list and value your assets and liabilities at your own pace, discuss provisions with your spouse over coffee for free, and feel less pressured to “fight for more”. Legal conference rooms are known to turn the most amicable of separations into a battlefield which leaves everyone injured.

Your typical Separation Agreement will contain provisions to deal with the following issues;

Of course, any other financial issues that you may need to contend with (except children’s matters) can form part of your separation agreement.

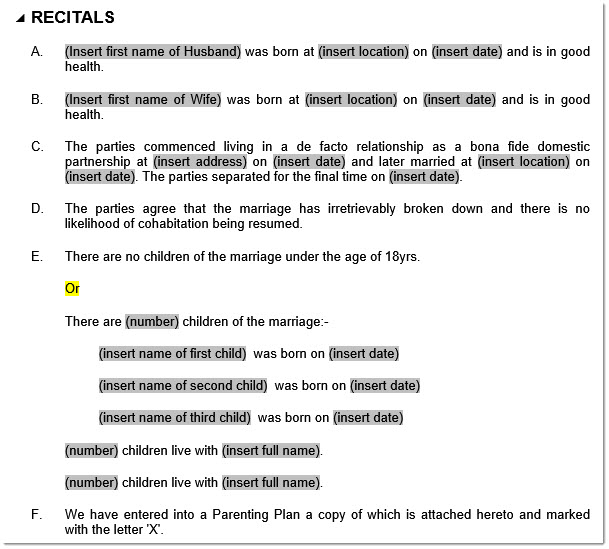

Recitals are a list of all the relevant facts of the relationship. A DIY Separation Agreement Template is handy in this situation as it will ask all the essential questions and ensure you have included everything necessary. Some things you will find in a recitals section include:

Sample of recitals in a separation agreement template.

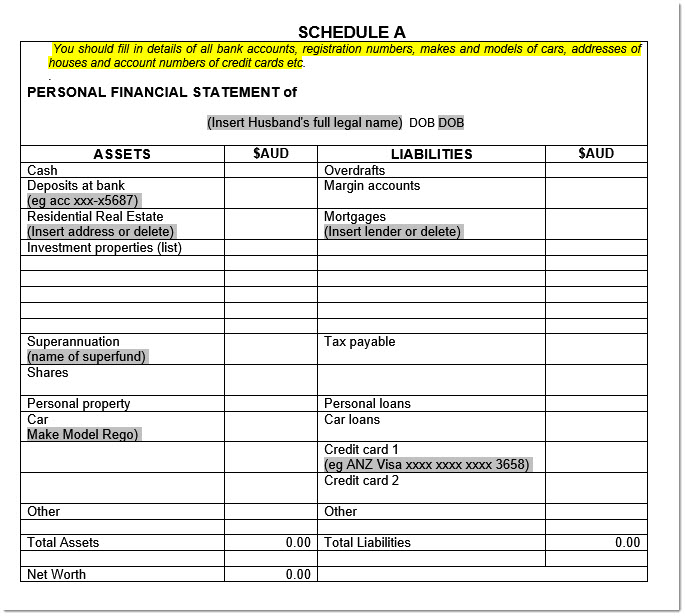

The property pool includes all of the assets and liabilities of the parties to the marriage or the de facto relationship which are owned jointly or individually. The Assets and Liabilities statements must include;

Liabilities are any money that a person may owe to other parties. This includes mortgages, car loans, credit cards, tax bills, land rates, and outstanding business debts for businesses a person may own.

Sample Assets and Liabilities Schedule from RP Emery’s Separation Agreement Template. There are three schedules included in the agreement, one for each party, and and for their joint property.

A Binding Financial Agreement requires you to assign a value to each asset or liability, but unlike court proceedings it does not require you to provide written proof of the value of each asset and liability. However, if it is discovered that one party has attempted to deliberately deceive the other, the agreement may be set aside by the court and the legal ramifications for non disclosure of a material matter, will be severe. The Family Law courts regards any omission or deliberately false statement within a binding financial agreement as a form of fraud.

RP Emery’s financial separation template kits are available to suit couples separating from a marriage or a de facto relationship. For under $150, the kit provides everything you will need to clearly put your agreement in writing, including:

If you follow the rules set down in the Family Law Act 1975 your agreement created from a template will be Binding. Meaning both parties are obligated to fulfil the terms of the agreement and honour their commitment. Should either party fail to meet their commitments the courts can enforce the agreement, which may result in substantial legal consequences.

To ensure an agreement drafted by the parties has legal standing that binds them, it must meet certain requirements set down in the Family Law Act ;

If you purchase your template from RP Emery, you also have the opportunity to acquire our fixed-price Legal Review Service, which provides legal advice for both parties from two independent lawyers, plus everything you need to turn your draft document into a binding agreement.

Besides failing to get legal advice Before signing your BFA, there are several very specific reasons set out in the Family Law Act that if met may mean your financial agreement is invalid or unenforceable.

If you love your legal research visit section 90UM of the Family Law Act for a full understanding of the Circumstances when the court may over rule (set aside) a binding financial agreement, in summary;

Most people have never needed a separation agreement, so it is natural to have many questions about how they work, what can happen without one, and what else should be considered when separating.

In Australia, there is no expiration date on a separation agreement. Unless the parties agree to mutually terminate the agreement or it is set aside by the court, your agreement will remain in force and binding on the parties.

A Binding Financial Agreement can only exist if both parties have been through the abovementioned process. Notarising this contract does not make it any more legitimate in the eyes of the Family Court. However, as part of the final step, you will need to have your signatures witnessed, preferably by your lawyer or a Justice of the Peace.

A secondary avenue open to amicable couples is applying for a consent order. This order is a binding decision by the Family Court based on an application from both parties seeking a financial order.

Consent orders do come with several drawbacks. The Family Court has to be “just and equitable”, which means they will not accept an application which it believes favours one party over the other. A typical example can be when the husband wants to keep his business in exchange for the wife keeping the house – but the company is technically valued at five times the value of the house. While a BFA can reflect the practicality that the business may be difficult to value and sell, the Family Court is unlikely to accept an outcome that appears inequitable.

Consent orders also require both parties to provide detailed evidence of the value of their assets and liabilities. For example written valuations for all significant assets such as a family business, motor vehicles or real estate interests. Providing documented valuations from a registered valuer, will add unexpected costs and stress.

Even simple matters may require an experienced lawyer familiar with the family court’s rigorous procedures to make an application on your behalf that will satisfy the court.

A Separation Agreement Template from RP Emery costs $ (less than half an hour of a lawyer’s time). If you purchase the legal review package that includes arranging for independent advice, you can have a fully Binding Financial Agreement for less than three thousand dollars. A dispute in the Family Court could easily cost ten times more in legal fees alone.

If you have separated or divorced without formally dividing your property, then the door remains open for an ex-spouse to launch a claim for a share of the other party’s property, even if that property was acquired after separation, for example an inheritance.

Of course, there are time limits when it comes to filing for consent orders, applications must be made within 12 mths of divorce or within 24 months of separation for a de facto relationship, unless you seek the court’s permission.

However, no such time restraints apply to a Binding Financial Agreement. You can make a binding financial agreement at any time after separation or divorce.

Once it has been twelve months after divorce or twenty-four months after a de facto separation, the Family Court is unlikely to hear a property settlement case without special circumstances. Fortunately, you are still able to create a binding financial agreement in this time.

Under Section 44 of the Family Law Act, the court can permit you to apply for property settlement after the deadline has expired. However, you must show that you or your children would experience hardship if permission were not granted. The court will also look at other factors, including:

A Financial Separation Agreement is specifically for dividing the assets and liabilities of the relationship. Several other agreements should be considered at the same time:

To be separated in Australia simply means that your relationship has ended. You don’t need your partner to agree to a separation; only inform them it is over. Because the date of separation can be significant, get written proof that this conversation has occurred – a text message or email will do. Other evidence of separation can be moving out or letting a third party know this has happened.

You can apply for a divorce when you have been separated for twelve months or more. Again, this does not require the consent of the other person. Only when you are divorced can you remarry, and only after divorce does the clock start ticking on how long people have to approach the court for a property settlement.

You do not have to wait for the divorce to begin a financial separation, and the earlier you begin this process, the easier it will be to protect your financial interests. Divorce is a separate process to financial separation, and it should not be assumed that you are protected after being granted divorce.

Yes! This is known as “separation under one roof”. While it may require you to fill out additional documents informing people of your separation, it is possible to separate and live in the same house.

If there is a dispute over whether or not you are separated, the court will look for several things. They will be interested in if there has been a:

The court may also ask for an explanation of why you did not leave the house and your intention to leave.

Once you are sure that your marriage cannot be reconciled, there is very little reason not to divorce. If you remain married, you will be unable to marry someone else. If you do not update your Will and pass away while only separated, your spouse will be legally entitled to the majority of your estate.

Some people still prefer to stay married, as it fits their personal or religious beliefs. In Australia, you can create a Separation Agreement and have total financial freedom while technically married. Be aware, however, that if you do not stick to the provisions of your agreement, the court may decide later that it is no longer valid.

Making a Binding Financial Agreement does not mean you will divorce. Many couples make an agreement before marriage (prenuptial) or during marriage and never separate. Making a financial agreement can be a great way to take stock of what you have, set clear future goals, and have conversations about money that you might otherwise be too uncomfortable to have.

You can apply for a divorce after twelve months of separation. If you have been married for less than two years, you may need to undertake relationship counselling or apply for an exemption (e.g./ domestic violence). There is no time limit for when you can apply for divorce.

For most of Australia, the commonwealth Family Law Act (1975) contains all the information regarding marriage, divorce, and de facto relationships. It applies to all living in NSW, Victoria, Tasmania, QLD, SA and the territories.

However, if you live in Western Australia, de facto relationships are governed by the Family Court Act (1997) (WA).

RP Emery provides templates explicitly drafted for de facto couples in Western Australia.

You should act decisively to protect your interests, even in an amicable separation. This is a time of great stress, and the more smoothly you reach complete independence, the less frustration you can face in the future.

When separating, you will want to remove your name from joint accounts and any bills that no longer affect you directly.

As your relationship can affect the benefits you receive from Centrelink and Medicare, you need to inform Services Australia of your separation. You will need to complete a separation form, which you can do online. If you are separated but still living together, you may also need to complete a “separated under one roof” form.

If you are separated but not divorced and have not updated your will, your partner will be legally entitled to a significant portion of your estate.

People in a relationship often have access to more accounts than they might ever realise. Treat your online security seriously by changing all passwords and asking your accounts to log out of all previous devices.

Letting your doctor know of this change in circumstance can be beneficial in many ways. They can help you take stock of your emotional situation, recommend support services in the community, and help you develop healthy techniques to deal with the emotional trauma that comes from separation.