Call Us -

1800 608 088

What if the borrower is in a failing relationship? Could the dreaded sister in law actually get half the money and not have to pay it back?

Whatever the circumstances there are few things more distressing than having a valued friendship go sour or a rift open up with family over money.

Documenting the loan agreement will help you avoid misunderstandings, eliminate doubt and provide a backup plan should things go awry.

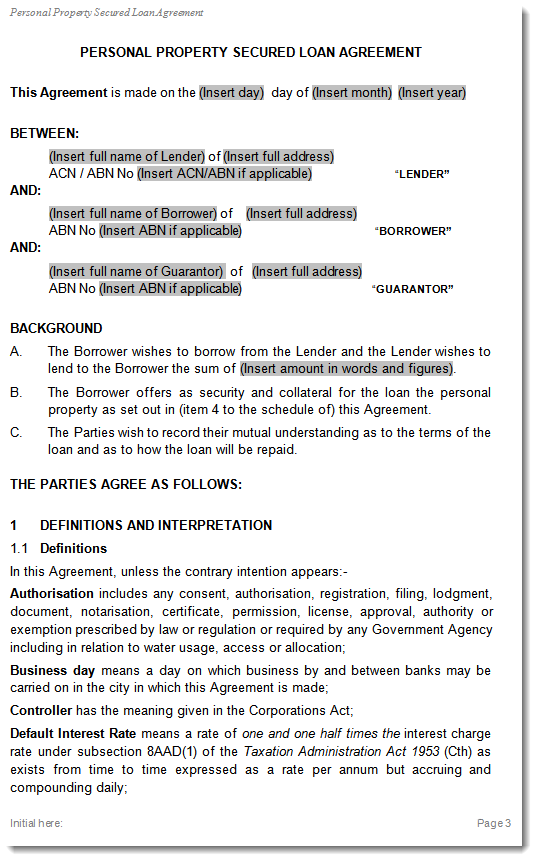

Our secured loan agreement clearly sets out

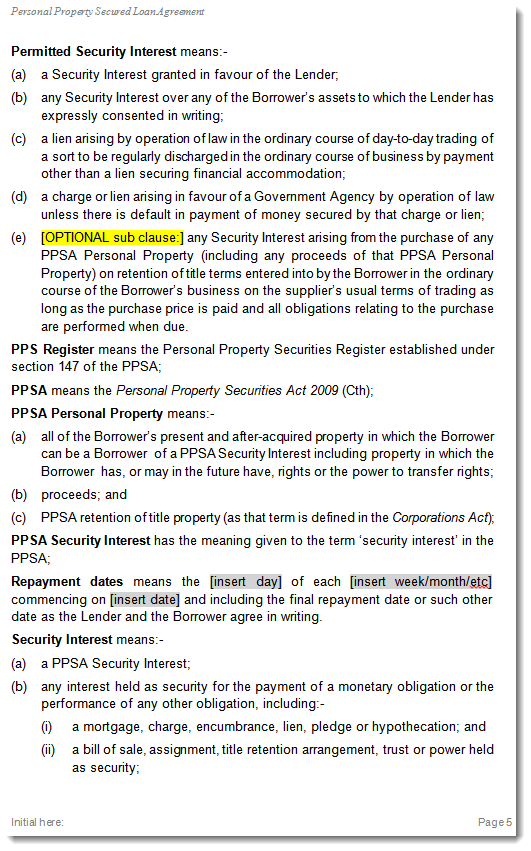

In order to comply with the recently introduced Personal Property Securities Act 2009, the lender and borrower must clearly document the property offered as security.

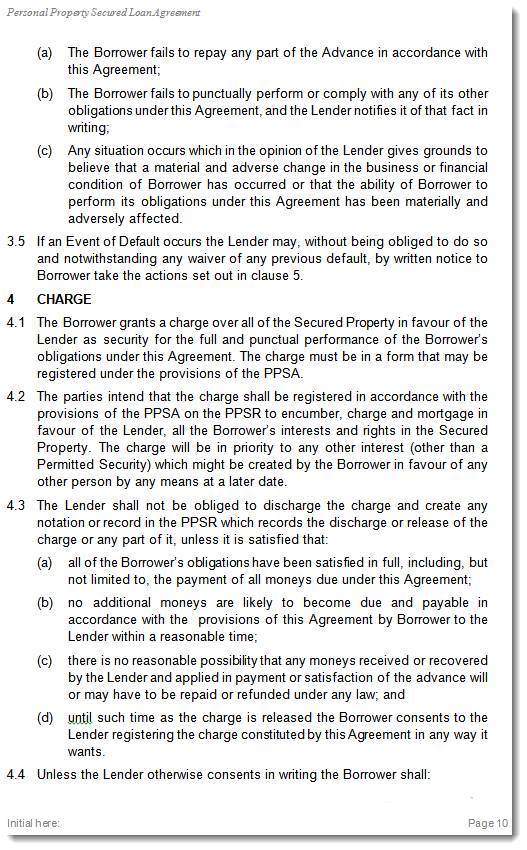

This agreement contains all the provisions required to create a loan so the lender can register their interest on the personal property security register (PPSR).

Along with a detailed users guide this secured loan agreement will give the lender the confidence that their interests are protected and borrower a clear understanding of their responsibilities.

Important Note: this agreement is not suitable for consumer credit transactions or where the security is land or buildings.

This Secured Loan Agreement has been professionally drafted and formatted for your convenience using Microsoft Word, it can be downloaded immediately and can be used time after time.

Simply insert the correct information in the appropriate fields and go to print.

Our fully secured ecommerce system allows you to purchase and download your Secured Loan Agreement safely.

Buy Secured Loan Agreement - Instant Download