Call Us -

1800 608 088

Every couple is different but there are common reasons why couples choose to put a prenup in place.

1. Protecting Individual Assets:

Scenario: Jane owns a successful business that she started long before meeting her partner, John. She wants to ensure that in the event of a separation, her business remains solely hers. A prenuptial agreement can specify that Jane’s business assets are protected and will not be divided in a divorce.

2. Safeguarding Inheritance:

Scenario: Emma is expecting a significant inheritance from her family. She wants to make sure that this inheritance remains her property, even if her marriage to Liam doesn’t work out. The prenup can outline that any inheritance received by Emma will be kept separate from the marital assets.

3. Clarifying Financial Responsibilities:

Scenario: Mia and Jack have different spending habits and financial priorities. To avoid potential conflicts, they decide to use a prenup to clearly define their financial responsibilities, such as how they will handle joint expenses, savings, and individual debts.

4. Protecting Children from Previous Relationships:

Scenario: Olivia has two children from a previous marriage. She wants to ensure that her assets are preserved for her children and not subject to division if her marriage to Ethan ends. A prenup can specify that certain assets are set aside for Olivia’s children, safeguarding their inheritance.

5. Avoiding Future Disputes:

Scenario: Lucas and Grace are entering their second marriage and want to avoid the financial disputes they experienced in their previous divorces. By creating a prenup, they can outline clear terms for asset division, which can help prevent future conflicts and ensure a smoother separation process if it ever happens.

6. Addressing Debt Protection:

Scenario: Sophie has significant student loan debt, while her partner, Daniel, is debt-free. They use a prenup to state that Sophie’s debt will remain her responsibility alone, protecting Daniel from being liable for her financial obligations.

7. Establishing Property Ownership:

Scenario: Noah and Ava are purchasing a home together before getting married. They want to establish clear ownership percentages in case their marriage ends. The prenup can detail the division of property and specify how much each person owns, ensuring a fair distribution based on their contributions.

8. Planning for Career Changes:

Scenario: Lily plans to leave her high-paying job to support her partner, Sam, who is pursuing a demanding career. They agree that a prenup will provide Lily with financial security and compensation for her career sacrifice if the marriage doesn’t last.

9. Ensuring Financial Independence:

Scenario: Max and Zoe both value their financial independence and want to maintain separate bank accounts and investments. A prenup can formalise their agreement to keep their finances separate, detailing how expenses and assets will be managed during the marriage and in the event of a divorce.

These scenarios illustrate how a prenuptial agreement can provide clarity, protection, and peace of mind for couples with diverse financial situations and concerns. By addressing these common reasons, couples can enter their marriage with a clear understanding of their financial future.

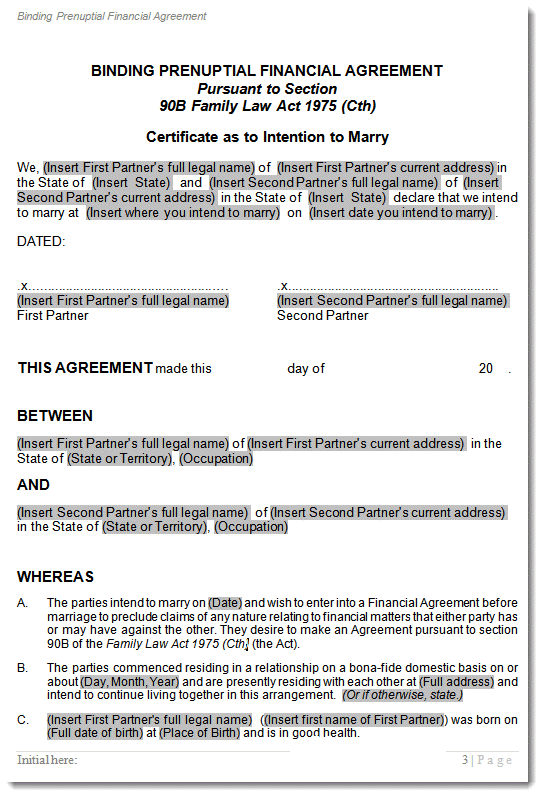

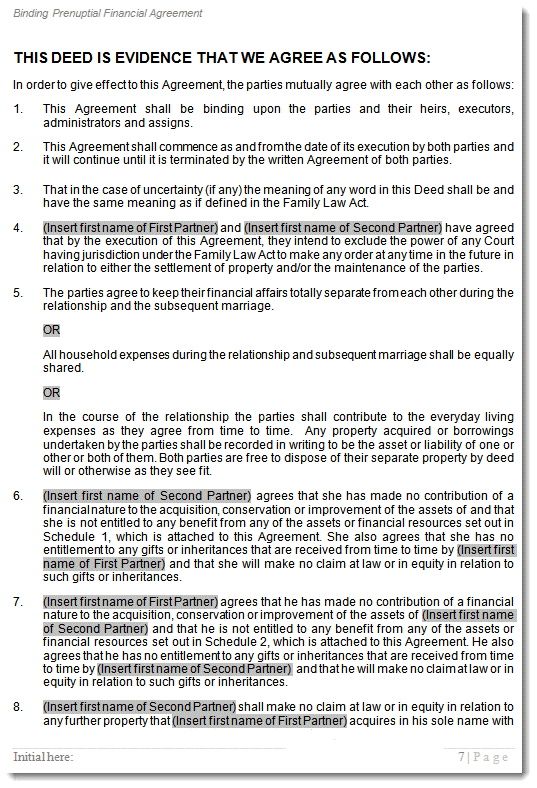

This comprehensive Pre Nuptial Financial Agreement Template Kit has been drafted to comply with section 90B of the Family Law Act 1975 and provides all the guidance you need to create a legally binding, protective Prenup.

Your financial agreement kit includes a comprehensive manual that explains the law as it applies to this agreement. It will show you in simple terms how to thoroughly cover important legal requirements, and how to complete your agreement in detail. In addition, it contains alternative legal clauses and provisions you can use to personalise your agreement.

We’re confident that our Prenuptial Agreement Template Kit will meet your needs. If you’re not completely satisfied, we offer a full refund. Plus, our dedicated support team is here to assist you every step of the way.

Buy Prenuptial Financial Agreement 90B Template Kit - Instant DownloadThe Family Law Act requires each party to receive independent legal advice before signing a prenuptial agreement. This ensures both parties fully comprehend their rights before entering the agreement and prevents misunderstandings.

Our financial agreement review service is available as an option with this agreement.

![]()

This means you can finalise your Prenup Agreement for just $ in most cases – more complex matters may require an additional fee but if it does you will know up front.

If you are planning on getting married soon it is inadvisable to enter a prenuptial agreement within eight weeks of your wedding.

You won’t find this warning anywhere in the Act it’s just something our lawyers believe could go to proving undue influence. If time is short and there is not enough to formalise your agreement before the wedding you can always make a Post Nuptial Agreement after the wedding.

If you are not intending to get married, you can still make a binding financial agreement or cohabitation agreement under s90UB or s90UC.

How Long Does It Take to Complete?

This depends on you – we have had couples complete their draft agreement within a few days, while others take weeks. As stated above, there are two parts to getting a legally binding agreement – completing the draft agreement and the legal advice. We cannot control how long it takes for you to complete the draft but once it’s done, we aim to have the legal advice complete within ten working days.

Is the Kit Suitable for All Jurisdictions?

Yes, our template is suitable for all Australian states. It’s drafted to comply with the Family Law Act 1975.

How Do We Get Legal Advice?

We offer access to fixed price legal advice to certify your agreement. Our service ensures that the mandatory independent legal advice is straightforward and affordable.

What If We Need Support?

Our customer support team is here to help. Whether you have questions about the process or need assistance with your document, we’re just a call or email away.

Completing the template is very straightforward – just add your information to the template. The grey fields indicate the information required, and our Users Guide walks you through each clause.

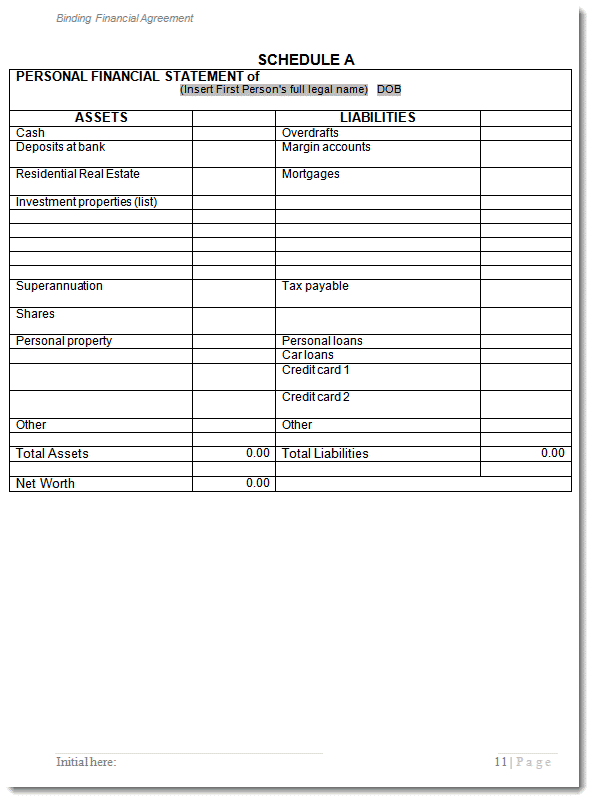

For the assets and liabilities sheets, you fill in what you both own or owe individually, and jointly.

Remember, all the information that you will add to this agreement is information that a lawyer would ask if they were drafting it for you.

Buy Prenuptial Financial Agreement 90B Template Kit - Instant Download