Call Us -

1800 608 088

Key Provisions of Section 109N:

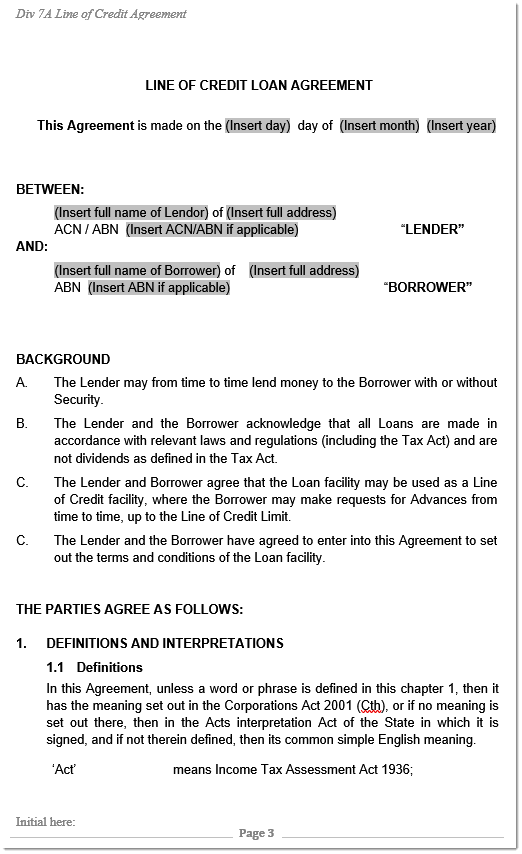

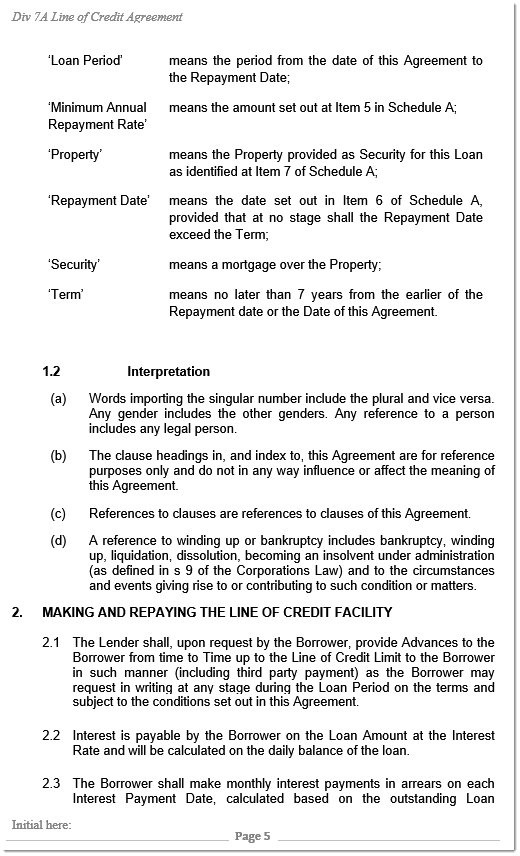

Written Agreement:

The loan must be documented in a written agreement before the lodgement day for the company’s tax return in the year the loan is made.

Benchmark Interest Rate:

The interest rate on the loan must be equal to or greater than the “benchmark interest rate” for that year, as determined by the Reserve Bank of Australia. This ensures the loan is not effectively a gift or disguised distribution of profits.

Maximum Loan Term:

The loan term must not exceed:

When Might You Use This Agreement?

Tax-Efficient Lending for Private Companies

This document will allow you to structure your loan correctly to avoid div7a penalties. It has been professionally drafted by Australian lawyers to meet the requirements of the Income Tax Assessment Act 1936 including those listed above, ensuring your loan won’t be treated as a dividend which could lead to higher tax liabilities.

Flexible Line of Credit with Clear Terms

Directors or shareholders can establish a Line of Credit facility with this agreement, accessing funds as needed, up to a pre-determined limit. You can draw, repay, and re-borrow within the specified term, ensuring you comply with the strict requirements of Division 7A while enjoying the financial flexibility this arrangement provides.

Secure Your Loan with Real Property

If you choose to secure the loan with real property, you can extend the loan term up to 25 years, provided that the property’s market value exceeds 110% of the loan amount and the security is registered. This allows you to leverage your assets effectively while ensuring the loan remains compliant with Division 7A.

Refinancing Options

Our agreement also provides for refinancing existing loans while maintaining compliance with Division 7A. If you’re looking to refinance an existing loan, our agreement ensures that the maximum term is adjusted appropriately, allowing for a seamless transition while avoiding potential tax pitfalls.

Our Division 7A Line of Credit Agreement complies with the ATO’s requirements and allows you to document your loan correctly.

Our template saves you re-inventing the wheel and gives you a cost effective way to meet your obligations.

Buy Div 7a Line of Credit Agreement - Instant DownloadIt is available for immediate download as Microsoft Word document which makes it easy to edit. In addition it can be used as often as you need.

There are other types of Division 7a Loan Agreements which operate like a standard loan where you pay money back rather than having a revolving line of credit. Here is a breakdown of the different loan templates so you can decide which one you need. Or so our article Division 7a Loan Agreements Tax Facts

| Type of Agreement | Loan Term | Secured/Unsecured | Use Case | Flexibility |

|---|---|---|---|---|

| Secured Division 7A Loan | Up to 25 years (secured by real estate) | Secured | Long-term lending needs with collateral | Fixed loan amount, no redraws |

| Unsecured Division 7A Loan | Up to 7 years | Unsecured | Shorter-term loans, no collateral required | Fixed loan amount, no redraws |

| Line of Credit (LoC) | Up to 25 years (secured), 7 years (unsecured) | Secured or Unsecured | Flexible access to funds; ongoing borrowing | Draw, repay, and redraw up to the credit limit |