Call Us -

1800 608 088

For Australian families, Superannuation (which is compulsory for most individuals) is an important part of long term wealth planning.

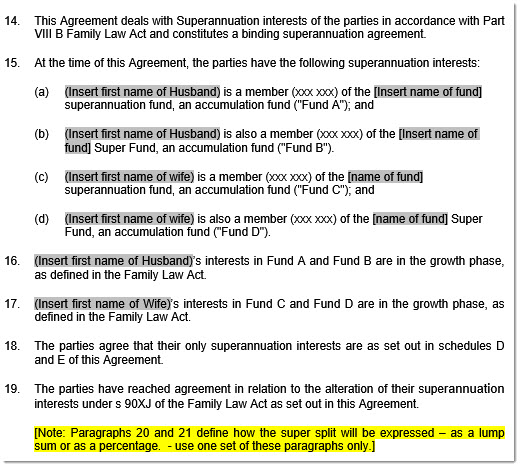

The Family Law Act 1975 makes provision for the splitting of superannuation assets between all separating couples. It makes no difference if you are a married couple or in a defacto relationship (hetero or same-sex), you can still divide your superannuation just as you would any other asset.

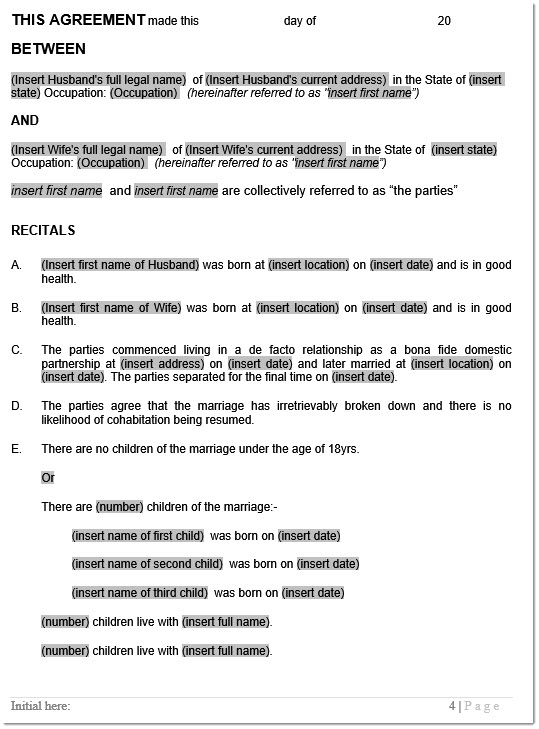

It is a written agreement, which complies with Part VIII B of the Family Law Act 1975 specifically dealing with the payment splitting or dividing of a superannuation interest.

This type of document is usually used after the relationship has finished but it can be used at any stage (before or during) to “flag an interest” in the assets.

Superannuation Agreements were introduced so that couples could have an alternate way of dividing their super assets without the need to make application to the Family Court.

If the couple cannot arrive at an amicable arrangement about their Super, then the Court has the power to make the decision for them.

Important note: The Family Law Act stipulates that this type of agreement is binding only when

For more information on obtaining the required legal advice at a fixed Low Rate please see our Doc Review Service

Reaching an amiable arrangement regarding your Super Assets is advantageous because:-

The Kit includes:

Are you married or divorced or exiting a defacto relationship?

Is your super held with an industry or retail superfund or do you control a Self Managed Superannuation Fund (SMSF).

Whatever your needs, we have an agreement template to suit your situation. If you can’t see your document on the list below please call us on 0266725904 or e-mail us and we will provide a link to the agreement you need.

It’s worthwhile noting that any amount transferred under a superannuation agreement will be treated in accordance with the normal rules that effect superannuation benefits. That is, you can’t take it as cash and go on a world trip unless you’ve already retired.

Click on the links below for the agreement that suits your purpose.

See All Superannuation agreements in our online store or click the links below.

| Splitting | Married, Separated, not yet Divorced | After Divorce | Defacto Separation |

| Industry or Retail Fund | Marriage Separation Financial Agreement inc Super Split 90C

Only $197.00 |

Divorce Financial Agreement inc Super Split 90D

Only $197.00 |

De Facto Separation Financial Agreement inc Super Split 90UD Only $197.00 |

| Self Managed Super Fund (SMSF) | Marriage Separation Financial Agreement inc SMSF Super Split 90C Only $197.00 | Divorce Financial Agreement inc SMSF Super Split 90D

Only $197.00 |

De Facto Separation Financial Agreement inc SMSF Super Split 90UD

Only $197.00 |