Call Us -

1800 608 088

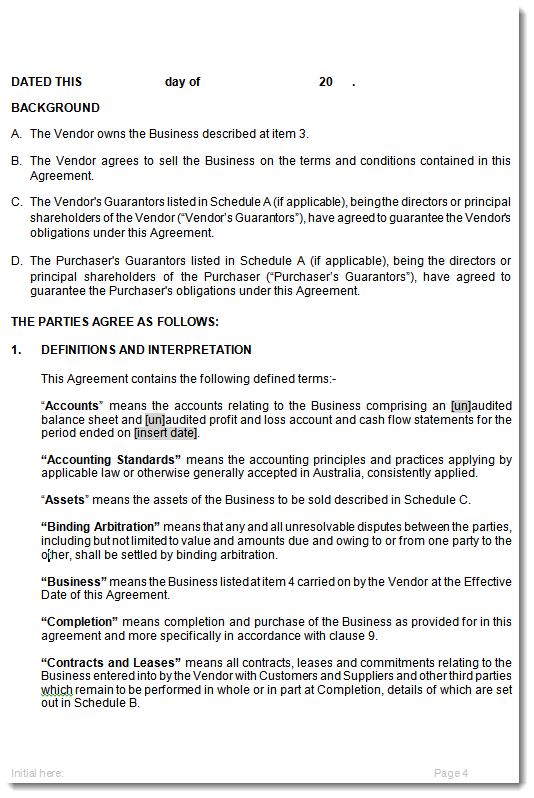

You can get started straight away, because this business sale contract is Available for Immediate download. Simply insert the correct information in the appropriate field and tab to the next. Now print your professional contract!