There is a pervading myth that divorce settlements in Australia split the assets and liabilities down the middle. The Family Court of Australia does not explicitly use a ratio system and instead has a complex and considered process that determines the proportion of assets each party will receive.

Note: It’s important to use the right terminology. “Property Settlement” refers to dividing the assets and debts of the couple – essentially, deciding who gets what. “Divorce,” on the other hand, only means the end of the marriage. So, to answer the question – Are Are Assets Always Split 50/50 in an Australian Divorce?, accurately in this article, “divorce” also implies “property settlement”.

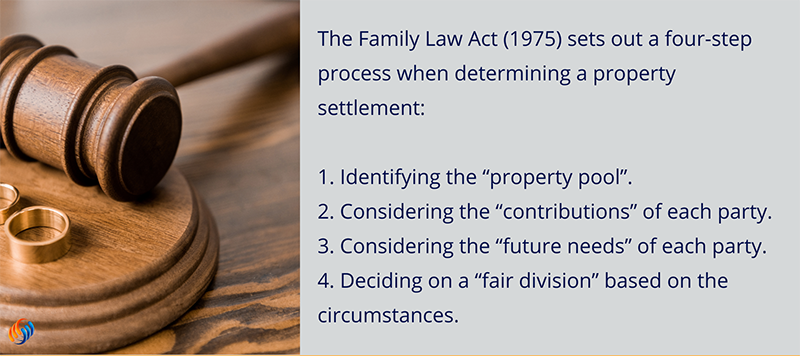

The Family Law Act (1975) sets out a four-step process when determining a property settlement:

- Identifying the “property pool”.

- Considering the “contributions” of each party.

- Considering the “future needs” of each party.

- Deciding on a “fair division” based on the circumstances.

Identifying Your Assets and Liabilities in a Divorce Settlement

To complete a property settlement, all assets need to be identified. Assets include real estate, any business or company controlled by either party, superannuation, bank accounts and inheritances. The inventory must also include all debts, including personal credit cards, mortgages, tax bills, and other liabilities. Even if a debt is only in one name, it must be identified and considered as part of the property pool.

For a cost effective way of settling property matters see Using a Separation Agreement Template in Australia.

The money you make after separation but before an agreement or order is legally finalised is included in this inventory. Any attempt to hide assets is classified as a type of fraud under the Family Law Act because doing so would mislead the other party and the court.

Considering the Contributions Made to a Relationship

In Australian Family law, the assets you bring initially into a relationship are not necessarily yours if the relationship ends. However, the courts consider who owned assets before the relationship and how the couple used them during the relationship. The court will also assess contributions made during the relationship, including:

- Income provided to either party.

- Gifts, Loans, and Inheritances.

- Non-financial contributions such as renovations or home improvements.

- Contributions made for the welfare of the family, including home-making and parenting.

The Australian Family Court places a high value on the role of homemakers and parents. For example, the spouse who foregoes a career to look after children is just as entitled to a share of the home as the spouse who was the primary financial contributor. Other contributions may include:

- Indirect benefits to the family through a spouse’s employment, such as a work-owned vehicle.

- Maintenance of financial investments.

- Nursing care, including for parents of the other spouse.

Considering Future Needs When Settling Assets

Section 75 of the Family Law Act 1975 lists several factors that must be considered when making a property settlement. These factors specifically relate to future needs and include:

- The age and health of each party

- The party’s role as a carer (of children or others).

- The capacity of each party to obtain and maintain employment.

- How the marriage may have impacted the earning capacity of each party.

- Child support payments that are being made or are likely to be made.

These are just some of the factors the courts will take into account. Most importantly, the court will attempt to ensure that both parties end with a reasonable standard of living – no party should be unjustly burdened by the other.

What Australian Family Law Considers “A Fair Division”

If the Family Court is put in the position of making an order, an eventual settlement of the property may end up looking closer to a 60/40 split, or even 70/30. However, the court may make decisions based on the valuation of property, businesses, and other assets you may disagree with.

To better ensure a division that suits your circumstances, you can avoid the court system and work together to create a binding financial agreement.

Check out Should You Get a Financial Separation Agreement in Australia?

Can We Split Our Assets by Ourselves?

The cost of property settlement and divorce in Australia can go into the tens of thousands of dollars. However, if the separation has been amicable, you can save a lot of money by arranging to split the property yourselves.

A financial separation agreement is a contract to split assets and liabilities after separation. Under the Family Law Act, this contract is known by the term “binding financial agreement”. This contract must contain an inventory of all financial concerns (the property pool) and how they would be divided. A carefully written agreement can allow a couple to split their assets differently from how the courts may decide.

You can create Binding Financial Agreements before a divorce has been granted or even use one during an ongoing marriage (sometimes referred to as an Post Nuptial agreement).

Creating a financial separation agreement that complies with Australian law can be made easier by using specially designed templates and having the draft reviewed by your lawyer. Arranging a financial separation using an Australian separation agreement template and legal review services from a respected provider can save you thousands of dollars in legal fees and be faster than a going through the court.