A person you have separated from can legally make a claim for your assets up to twelve months after a divorce or twenty-four months after a de facto separation. To protect yourself and become financially independent once more, you should enter into a Financial Separation Agreement. Learn more about Using a Separation Agreement Template in Australia. These agreements set out the assets and liabilities of both people and provide instructions on how these will be split. In Australia, they are known as a Binding Financial Agreement.

Without an agreement to protect you, a dispute over assets can lead to Family Court hearings that are long, stressful, and can cost you tens of thousands of dollars. In the end, there is a strong chance the court will order a division that pleases no one. While communicating with the other person can be a little stressful, sitting down to create a Financial Agreement is the path of least resistance.

How Do You Become Legally Separated in Australia?

Unlike other places in the world, separation in Australia is simple. It only requires one party to believe a relationship is over and to have told the other person. While some government services may require you to fill out paperwork during a separation, you do not need to apply to the court for official paperwork.

However, separation isn’t enough to protect your property. Without an agreement, consent order, or hearing, financial separation has not happened. Your ex-partner may still have a legal right to the money you make or accrue debts for which you may be responsible.

A Binding Financial Agreement (BFA) can be used to protect your assets if your relationship breaks down. A BFA can be made before marriage in what we commonly call a “prenuptial agreement”. It can also be made during a marriage or after a divorce. Each agreement is slightly different, and it is important to recognise whether it is for a marriage or de facto separation.

Most of the information you will find here applies to all separation agreements, but it is essential to select the correct one if you choose a template to create your own.

What Is a Financial Separation Agreement in Australia?

A Financial Separation Agreement, better known as a Binding Financial Agreement, is a contract between two people who have separated from a marriage or de facto relationship. This agreement requires a detailed inventory of all assets and liabilities of each person, even if it is in their own name.

The Financial Separation Agreement must then provide instructions, in detail, for how each of these assets and liabilities will be split. This will include who might be responsible for transferring ownership, selling assets, or making ongoing payments.

A Financial Separation Agreement also contains recitals (agreed-upon facts about the relationship and separation), clauses related to spousal maintenance, and several other sections that must be covered for it to comply with Australian law.

Commonly listed assets found in a Financial Separation Agreement include:

- Residential properties, including investments

- Savings accounts, shares, bonds, and superannuation

- Vehicles, furniture and other household items

- Jewellery and other valuables

- Businesses owned by either party.

The liabilities of a person are all the debts they owe, including ongoing payments. Common liabilities include:

- Mortgages, personal loans, and credit cards

- Rates and utilities

- Business loans which a person may be responsible for

- Unpaid tax bills.

What Does a Financial Agreement Cost to Make?

If you are working with lawyers to draft a separation agreement, you may end up spending over ten thousand dollars. Your typical family lawyer in Australia charges a minimum of $350 per hour. They will need to sit down and help you create a complete inventory, talk you through the different decisions you could make, and may even encourage you to let them arrange the valuation of the property. As the other person in the agreement will have their own lawyer in this situation, there will also be conferences with both lawyers present as you debate the decisions. Sometimes the stress of such formal settings can lead to combativeness and arguing over decisions that would have been easy if you discussed them instead over a cup of coffee.

In the end, a draft separation agreement made by Australian lawyers could cost thousands of dollars each.

Can We Write Our Own Separation Agreement?

Fortunately, creating a DIY Financial Separation Agreement is a legal alternative for couples in Australia. An amicable couple can save a lot of money by obtaining a Marriage or de facto Separation Agreement template that complies with our local laws and following the instructions together.

A Financial Separation template purchased from a reputable group will be created by Australian lawyers, fit the type of separation you are going through, and comply with the Family Law Act (1975). RP Emery offers DIY templates for marriage separation, divorce, de facto separation, and prenuptial agreements. We also offer legal review packages to help you create a contract that complies with the law and provide you with the legal advice required to make an agreement binding.

What Makes a Financial Agreement Binding?

A Binding Financial Agreement will be recognised by the Family Court of Australia as valid if a dispute arises. Unless a couple goes through a specific process to make their agreement binding, the court will put aside the agreement and decide itself how the property will be divided. The hearing to make these decisions can be long and expensive, with many divorce proceedings costing an individual over a hundred thousand dollars.

The technical requirements for binding an agreement are set out in sections 90G and 90UJ of the Family Law Act. According to these sections, before signing the contract, each person must be “provided with independent legal advice from a legal practitioner about the effect of the agreement on the rights of that party and about the advantages and disadvantages, at the time that the advice was provided, to that party of making the agreement.”

This means you must have a different lawyer for each person, and that lawyer must step you through what is good and bad about this contract for you personally. It’s essential to note that this advice is for this version of the agreement and the circumstances you are in at the time the advice is given.

After this advice is given, the lawyer will provide you with a written certificate known as a “legal practitioner’s statement”. Both people must provide a copy of the certificates to be added to the agreement before signing it. The agreement must not be changed after advice is given.

Only after this entire process has been completed will the Financial Separation Agreement be considered binding by Australian law.

Can a Binding Financial Agreement Be Found Invalid?

There are many reasons why a Binding Separation Agreement may still be set aside by the court. Some of the most common include:

- It has failed to include all assets and liabilities of both parties

- It was not updated after changes to the care and welfare of a child connected to the relationship

- It was used to avoid creditors

- One of the people was already a part of another agreement

- It contains clauses that should be a part of a separate agreement (e.g./ child custody matters).

Can I Use a Free Template?

Overseas companies are advertising “free” agreement templates online. While they promote to Australians, their templates do not comply with Australian laws. Writing a DIY Separation Agreement using these as a starting point may result in you having to spend thousands of dollars with a lawyer to make it compliant.

Check to see if an Australian lawyer has drafted your separation agreement template. RP Emery can provide you with a template that complies with the correct Australian and Western Australian laws, and is written to suit the binding financial agreement you require.

Does It Matter What Template I Use?

Yes! Sometimes, all it takes is a single invalid clause for your Binding Financial Agreement to be set aside by the court. While a De Facto Separation Agreement template may look the same as a divorce separation template, they are not.

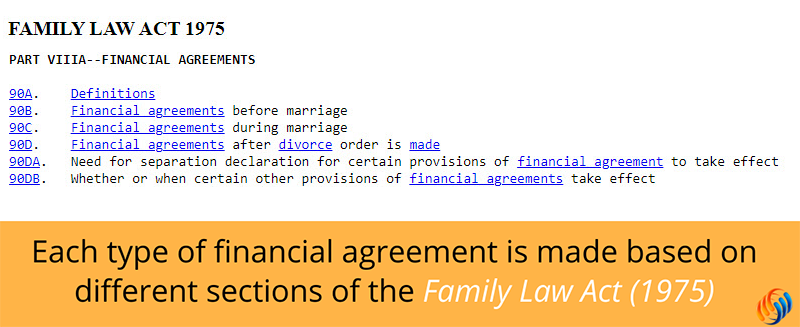

Each type of financial agreement is made based on different sections of the Family Law Act (1975). For example, financial agreements made before marriage (commonly known as prenups) fall under section 90B, while agreements made during a de facto relationship are made under 90UC.

BFA’s are made under different sections of the Family Law Act 1975

When you make your financial agreement, the legal definition of your relationship, is of significant importance when choosing a Separation Agreement template. If you need help choosing the correct document for your needs, you can contact RP Emery on 1800608088.

What Does a Financial Settlement Cost?

If two people cannot agree on how their assets are divided, they may end up having a hearing at the Family Court of Australia. These cases often cost an individual over a hundred thousand dollars, even for simple situations. Even if you can agree but want to let the lawyers handle everything, costs can move over ten thousand dollars before you realise it.

Working together and using a template from RP Emery, you can create a Binding Financial Agreement for under three thousand dollars (as at March 2023) . By purchasing a template and legal review package, you can receive the appropriate documents, detailed instructions on how to fill it out, feedback from our experts, and access to lawyers for both parties.

Frequently Asked Questions about Financial Separation

There are a lot of myths surrounding separation and divorce in Australia. With all the terminology that goes with it, it is natural to have questions and concerns. Questions range from the difference between divorce and separation, to how things might be different based on where you live.

Is a Notarised Separation Agreement Legally Binding?

Having a separation agreement notarized does not make it legally binding in Australia. The only way to ensure you have a Binding Financial Agreement is to go through the process as described above. RP Emery offers legal review packages that make this process easier.

Is a Separation Agreement Binding in Western Australia?

Western Australia has some family law matters governed by its own legislation. Binding Financial Agreements for de facto couples will need to comply with the Family Law Act 1997 (WA). If you use a Financial Separation template and are from the state, choose one suitable for Western Australia.

Should I Get a Divorce if Separated?

The Family Law Act requires you to wait twelve months after separation before divorce, and this is an excellent time to consider if there is any chance for reconciliation. If there isn’t, then there is little other reason to stay married. You will be unable to remarry and, if you haven’t updated your will, the other person will likely receive the majority of your estate.

However, many people have personal or religious reasons to stay married while separated. It is possible to do this while protecting your property, finances, and children. While you may be unable to remarry, you can live an otherwise independent life.

What Else Should Be On My Separation Checklist?

Separation is a stressful time, and it can help to make or use a checklist of things you need to take care of. RP Emery offers free checklists for married and de facto couples who are separating. Some of the common tasks everyone will need to face include:

- Updating your details on government services like Centrelink and Medicare

- Updating your will and insurance policies

- Changing passwords for banking, email, and social media.

- Remove names from or close joint accounts.

Separation is a traumatic experience for everyone involved. It can bring up feelings of anger, grief, and depression. For many people, it can even lead to self-destructing behaviour. There are counselling services available to you both privately and paid for by the government.

Even if you feel like you are handling things well, set an appointment with your general practitioner and talk to them about what is happening. They can guide you to appropriate services that can help you emotionally and practically.