Call Us -

1800 608 088

Going through a separation or divorce is seldom easy – it’s rated as one of the most stressful things you will ever do. Not only do you have to deal with the emotional fall out, you also need to organise the disentangling of your finances. Throw children into the mix and it becomes more complicated.

This page points you to wealth of resources on separation and divorce – primarily to help you organise the property settlement. The property settlement options for married and defacto couples is the same, but married couples will need to dissolve the marriage as well, that is, get a divorce.

Learn: How to apply for Divorce

Note: issues relating to the care and welfare of children(custody) can only be addressed through the court system if you are unable to resolve the dispute yourself.

Property Settlement is the process of determining how assets and liabilities of the relationship will be divided between the parties.

When contemplating the property split, consider:-

There is no set formula to determine how property will be shared. Rather, how you agree to handle your financial matters will be based largely on your own unique circumstances. Considering issues, such as those listed above, can help you arrive at a fair and equitable resolution satisfactory to both parties.

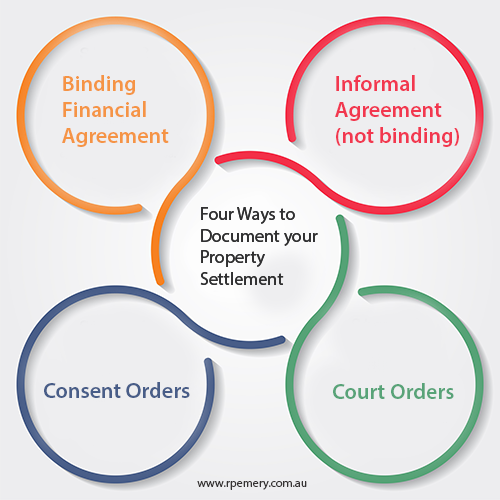

A couple may finalise their agreement relating to financial issues by:-

Learn: How to handle property after separation

Learn: Why delaying property settlement can cost you more

Learn: How is mediation used in Property settlement?

Learn: Counselling Resources for Family and Relationship Issues

Learn: Do I need to go to Court?

A Financial Agreement is a document that allows you to choose how to divide property and financial resources in the event of a relationship breakdown.

Learn: Will a Financial Agreement work for us?

Learn: You can save thousands of dollars in stamp duty by using a financial agreement

Financial Agreements for separation must comply with the relevant sections of the legislation.

The easiest way to write a separation agreement is to start with a template customised to your situation and the relevant section of the Family Law Act, far example, 90C for separation or 90D for divorce.

A template agreement establishes the sub-structure of a legal contract. It provides the legal framework and essential clauses that form the foundation of a document that you can tailor to your own particular circumstances. Lawyers nearly always start with a template agreement, or what is known in the profession as a precedent.

Learn: How to make sure your Financial Agreement stands up

When a marriage breaks down, reaching an amicable arrangement quickly about debts, assets and property can reduce conflict and stress.

When a marriage breaks down, reaching an amicable arrangement quickly about debts, assets and property can reduce conflict and stress.

This Separation kit which has been drafted to comply with Section 90C of the Family Law Act provides the legal framework for you to arrange your affairs and saves you hundreds, if not thousands of dollars, in legal fees.

De facto couples who wish to finalise, all matters of a financial nature in dispute between them, including spousal maintenance, child maintenance and the division of property.

De facto couples who wish to finalise, all matters of a financial nature in dispute between them, including spousal maintenance, child maintenance and the division of property.

As long as the couple are communicative and willing to resolve their issues then it can be done by entering into a Financial Agreement.

Financial agreements (Separation Agreement) negate the need for the couple to enter court proceedings, reducing the risk of extended litigation and providing certainty of outcome.

Learn: Time Limits for De facto Couples

Divorced couples who wish to finalise, all matters of a financial nature in dispute between them, including spousal maintenance, child maintenance and the division of property.

Divorced couples who wish to finalise, all matters of a financial nature in dispute between them, including spousal maintenance, child maintenance and the division of property.

Provided for under the Family Law Act 1975, Section 90D refers to Financial Agreements after the divorce order is made. Like other Financial Agreements, section 90D focuses on the division of financial resources of both partners.

Did you know a couple can be legally separated, while still residing “under the one roof”?

There are many circumstances in which a couple may decide to separate under the one roof.

Usually, this is for financial reasons. The parties may not be able to afford separate rent if they have already have substantial mortgage commitments. Or they might decide it is in the best interest of the children if they continue to live under the one roof for a time. Perhaps the parties may not wish to move out until they have reach and implemented a formal agreement about how they will deal with the family home and the division of other joint property.

Learn: Is it possible to “separate under the one roof”?

For Australian families, Superannuation (which is compulsory for most individuals) is an important part of long term wealth planning.

The Family Law Act 1975 makes provision for the splitting of superannuation assets between all separating couples. It makes no difference if you are a married couple or in a defacto relationship (hetero or same-sex), you can still divide your superannuation just as you would any other asset unless you are in West Australia.

There are three ways to divide superannuation, Superannuation Agreements, Court Orders and consent orders

A Superannuation Splitting agreement is a written agreement which may be included as part of a Binding Financial Agreement made in accordance with the Family Law Act 1975 (cth) . Specifically, the agreement may include provisions dealing with the payment splitting or dividing of a superannuation interest.

A Superannuation Splitting agreement is a written agreement which may be included as part of a Binding Financial Agreement made in accordance with the Family Law Act 1975 (cth) . Specifically, the agreement may include provisions dealing with the payment splitting or dividing of a superannuation interest.

This type of document is usually used after the relationship has ended but it can be used at any stage (before or during) to “flag an interest” in the superannuation assets.

Superannuation Agreements were introduced to give couples an alternate way of dividing their superannuation without the need to make application to the Family Court.

If the couple cannot arrive at an amicable arrangement about their Super, then the Court has the power to make the decision for them.

Important note: The Family Law Act stipulates that this type of agreement is binding only when

For more information on obtaining the required legal advice at a fixed Low Rate please see our Doc Review Service

It is a requirement of the Family Law Act that each party needs to obtain independent legal advice (as to the advantages and disadvantages of entering into the Agreement) before the agreement becomes legally binding.

Before your financial agreement becomes legally binding it must contain

This prevents either party from arguing that, when signing the agreement, they did not understand what they were signing or its consequences.

With this in mind we have negotiated a reduced rate for our customers with several independent, nationally licensed lawyers who can provide the required advice by telephone and e-mail.

Learn: Video – Why do I need Legal Advice for a Financial Agreement?

Learn: Why do I need to make full disclosure in a Financial Agreement?

Learn: Can my family lawyer finalise my Financial Agreement?

People should not confuse American law and terminology with Australian law. Unlike America, we have no such thing as “alimony”, here we use the term “Spousal Maintenance”.

Spousal maintenance is a support payment made by one partner to their spouse who is unable to support his or herself after the parties have separated or divorced. It can be negotiated by the couple themselves, or in some circumstances awarded for a limited time by order of the court.

Parties in a de facto relationship are also eligible to receive de facto partner maintenance, in circumstances where a de facto partner is unable to adequately support themselves after the relationship has ended.

If you are separating, you should try to reach an amicable agreement about your finances, including whether one partner should continue to maintain (in whole or in part) the other party.

The likelihood of spousal maintenance being paid, and the extent of the payments, will vary depending on various factors – firstly, whether one party can actually afford to support the other, and to what extent.

The Family Law Act sets out a list of things to consider when assessing whether spousal maintenance should be paid. It is not a “one rule fits all” scenario, but rather, a set of guidelines to assist in determining whether spousal maintenance payments would be appropriate.

Learn: Do I need to pay spousal maintenance?

Learn: How to include Spousal maintenance in a Financial Agreement

After separation it is common for a couple to transfer the ownership of property, whether it be the family home, investment properties or both.

Usually the property is transferred from

To transfer property, a Transfer form needs to be registered with your State Lands department.

Learn: How to transfer property after separation

Parents use a Shared Parenting Plan to document how they plan to share the care of their children after a separation or divorce.

Parents use a Shared Parenting Plan to document how they plan to share the care of their children after a separation or divorce.

Learn: How to make a Shared Parenting Plan

Separated parents (married or defacto) have a legal obligation to support their children (biological or adopted) financially and emotionally.

Separated parents (married or defacto) have a legal obligation to support their children (biological or adopted) financially and emotionally.

This Agreement allows you to document your child support arrangements clearly so that both parties understand their obligations. Having a written record in place decreases the potential for future conflict.

It is true that the requirements for signing a financial agreement are a little different to those that apply to signing a standard contract.

It is true that the requirements for signing a financial agreement are a little different to those that apply to signing a standard contract.

The Family Law Act sets out specific requirements that must be met for signing financial agreements, in order for the agreement to be binding.

Family Law Courts place a high value on the contribution of the Stay-at-home parent or homemaker as shown by the recent case Elgin & Elgin, who separated after 49 years of marriage.

Family Law Courts place a high value on the contribution of the Stay-at-home parent or homemaker as shown by the recent case Elgin & Elgin, who separated after 49 years of marriage.

Some people really know how to get themselves into strife. Let’s take the example of Brian who recently left his wife, inherited 400k and set up a new de facto relationship with his mistress of 11 years. Can he protect his inheritance from the settlement from his ex?

Some people really know how to get themselves into strife. Let’s take the example of Brian who recently left his wife, inherited 400k and set up a new de facto relationship with his mistress of 11 years. Can he protect his inheritance from the settlement from his ex?

Generally, a couple has 12 months from the date of divorce to make a property claim in the Court. For de facto couples, this rule is 2 years from the date of separation. However, nothing is ever black and white. The Family Law Act allows claims to be brought out of time and claims have been allowed to proceed out of time by a few days… to years.

Generally, a couple has 12 months from the date of divorce to make a property claim in the Court. For de facto couples, this rule is 2 years from the date of separation. However, nothing is ever black and white. The Family Law Act allows claims to be brought out of time and claims have been allowed to proceed out of time by a few days… to years.

“I inherited some money from my father and a friend separately and some years apart. I subsequently bought a flat (apartment) for roughly to the same value as both inheritance monies combined. I am now divorced and about to go through the legal process to sort out the assets as both parties cannot agree on a settlement arrangement. Are those inheritance monies considered part of my asset pool from which my ex-wife has a claim?”

“I inherited some money from my father and a friend separately and some years apart. I subsequently bought a flat (apartment) for roughly to the same value as both inheritance monies combined. I am now divorced and about to go through the legal process to sort out the assets as both parties cannot agree on a settlement arrangement. Are those inheritance monies considered part of my asset pool from which my ex-wife has a claim?”

How can a mother quarantine assets from a separated spouse so that they pass to her children?

How can a mother quarantine assets from a separated spouse so that they pass to her children?

A recent Canadian Court case highlights the importance of formalising a separation when property and children are involved. In this particular case, a man was able to prove that he still entitled to half of a property he purchased with his estranged wife over fifty years ago.

A recent Canadian Court case highlights the importance of formalising a separation when property and children are involved. In this particular case, a man was able to prove that he still entitled to half of a property he purchased with his estranged wife over fifty years ago.

Money is a major source of conflict in personal relationships. Open and honest communication about financial goals and money habits is a useful strategy for minimising money arguments.

Money is a major source of conflict in personal relationships. Open and honest communication about financial goals and money habits is a useful strategy for minimising money arguments.

If you are separated or divorced from your children’s other parent, the holiday season can be an extremely difficult time for all involved. You’ll naturally worry about whether you’re being the best parent you can be and trying to find the delicate balance between making your children happy and making everyone else happy.

If you are separated or divorced from your children’s other parent, the holiday season can be an extremely difficult time for all involved. You’ll naturally worry about whether you’re being the best parent you can be and trying to find the delicate balance between making your children happy and making everyone else happy.

Tired of arguing with your ex over childcare issues? You can create more harmony in your co-parenting relationship by using a parenting plan. A Parenting Plan is a mutually-agreed-upon plan that formally documents the parenting arrangements for children after their parents divorce or separate.

Tired of arguing with your ex over childcare issues? You can create more harmony in your co-parenting relationship by using a parenting plan. A Parenting Plan is a mutually-agreed-upon plan that formally documents the parenting arrangements for children after their parents divorce or separate.

A recent case in the Family Court set the precedent of allowing the Australian Tax Office (and other bodies) to access family court documents for purposes unrelated to the court proceedings such as tax audits and assessments.

A recent case in the Family Court set the precedent of allowing the Australian Tax Office (and other bodies) to access family court documents for purposes unrelated to the court proceedings such as tax audits and assessments.