Call Us -

1800 608 088

Retail Property can be an astute investment with potentially better returns than residential properties. There are several resources which we hope you will find useful if you are the owner of commercial premises and entering into leasing arrangements with your prospective tenants.

This page will help you to determine the best way to document your commercial lease, particularly those deemed to be Retail Leases.

Although the definition of retail property premises varies from state to state, generally speaking, a Retail Property Lease refers to any leased commercial premises that are used for the provision or sale of goods or services to an end user.

Retail property refers to any premises that is a shop. Retail premises is different to commercial premises which usually covers places like offices, factories and warehouses. If you are looking for Commercial leasing information please go our Commercial Contracts and Resources page.

Retail leasing is a subset of commercial leasing. Essentially, any commercial lease where the premises would be used as a retail shop (as defined in each retail leases act) is subject to the Retail Leases Act in your state or territory and therefore referred to as a Retail Lease.

Most shop premises would be defined as Retail Premises, however it is not the building itself that determines if the premises are retail premises, (with the exception of large shopping centres) but the permitted use of those premises or the business activity of the tenant.

A “lease” is a contract where one party (the lessor or landlord) grants another party (the lessee or the tenant) the right to occupy and use a certain piece of land, in exchange for money or “rent.” Leases can be verbal or in writing, however retail leasing laws require all retail leases to be in writing.

A retail lease agreement is a written agreement where one party (the lessor or landlord) grants another party (the lessee or the tenant) the right to occupy and use Retail Commercial Premises.

Each Australian state and territory has developed retail tenancy legislation to ensure fairness in the dealings between landlords and tenants.

When you are drafting your retail lease, it is wise to use a template which complies with the state laws so you can be confident you are following the letter of the law.

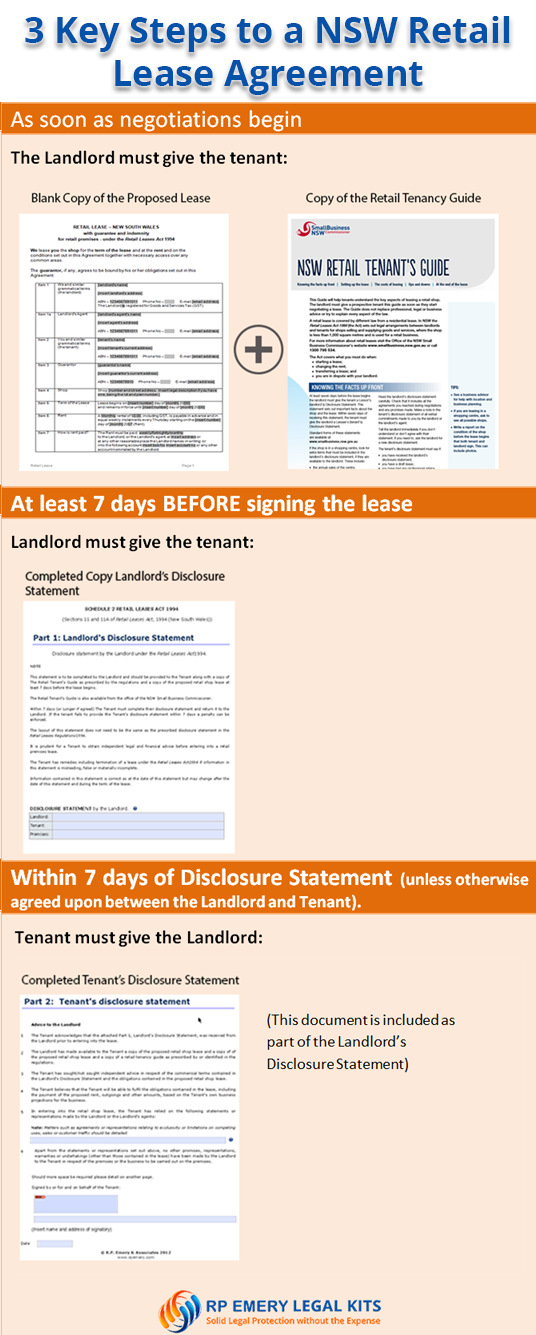

As a landlord, you also need to provide a Retail Lease Disclosure Statement – it’s an important component of the Retail Leasing arrangement.

The Disclosure Statement is essentially a summary of the most important aspects of the Lease. It assists potential tenants to make a fully informed decision as to whether it is viable to enter into a retail lease.

The Disclosure Statement helps bring important obligations that may be buried in the small print to light, providing the tenant with an easy to read summary of the most important and onerous aspects of the lease.

All of our Retail Leasing Kits include the Disclosure Statement or you can purchase a Disclosure Statement on its own.

Learn: Why is a Retail Lease Disclosure Statement necessary?

Learn: Why is it so important for a Landlord to be honest in Retail Lease negotiations?

The legislation sets out specific procedures that must be followed when entering into a new Retail lease. These may include;

This is the process for NSW – see the links for the other states below.

View the Step by Step Guides (as above) to Creating a Lease By State

A retail lease agreement should include all the provisions required by law to manage the tenancy. These include provisions regarding:

Our retail lease template is available for each Australian State and covers all of the necessary provisions and complies with the relevant laws.

Our retail tenancy kit with easy to follow instructions gives you the tools you need to successfully manage your shop tenancy.

This retail shop lease will protect your investment by defining the relationship with your tenants and shielding you from potential liability.

In fact, a well-crafted lease is compulsory under the Act and should be the foundation for the ongoing relationship between you and your tenant.

Sometimes the best option is not to lease a whole commercial space just for yourself. Maybe you don’t need that much room, the cost is too high or you feel reluctant to commit to a long term lease.

There are other options.

What is a Sublease Agreement?

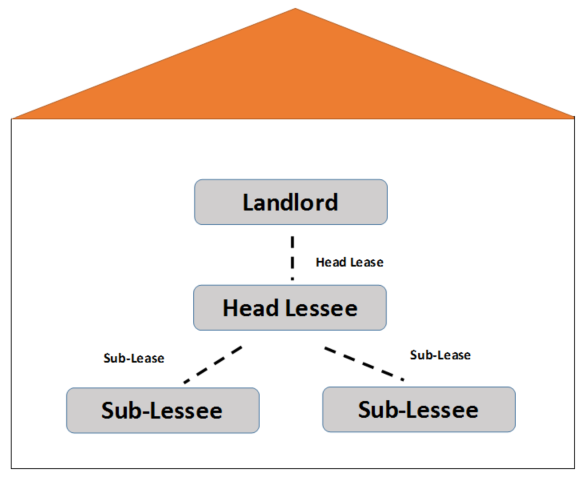

A Commercial Sublease Agreement is used to sub-let the whole, or a part of, leased premises.

It creates a legal relationship between the incoming sub-tenant and the existing tenant (head-tenant), creating certain rights and obligations between them (and not the landlord) – in short, the right to occupy a certain area, in exchange for a specified rent amount.

It is important to note that it is the existing tenant who will remain liable under the terms of the original Lease Agreement.

Commercial Sublease Agreement Template

Commercial Sublease Agreement TemplateUse this template agreement to document the obligations of the sub-tenant and head-tenant.

Learn More: Landlords Rights and Obligations when a tenant seeks to assign or sublet a Retail Lease.

Learn more: The pros and cons of Subleasing a commercial premise

Learn more: How to provide an option to a sub-tenant

Use this agreement when the parties to a commercial lease agreement wish to alter the terms and conditions of the agreement, such as rent payments or the duration of the agreement

Use this agreement when the parties to a commercial lease agreement wish to alter the terms and conditions of the agreement, such as rent payments or the duration of the agreement

An Assignment of Lease Agreement (in some states referred to as a Transfer of Lease) transfers an existing tenant’s leasehold interest to the new tenant, creating rights and obligations as between the new tenant and the landlord.

In effect, the new tenant agrees to step in and take over the existing tenant’s rights and obligations under the Lease. The new tenant becomes bound to the terms and conditions of the Lease, taking the place of the existing tenant, who is then released from it’s obligations as at the date of transfer. In this instance, a tenant who has assigned, or transferred, their leasehold interest will not be liable if the new tenant defaults.

Learn more: What’s the difference between assigning and subletting?

In business, it is prudent to conduct targeted enquiries such as bankruptcy and company searches on the parties you are considering dealing with so you can make sure you are not exposing yourself to unnecessary risk

In business, it is prudent to conduct targeted enquiries such as bankruptcy and company searches on the parties you are considering dealing with so you can make sure you are not exposing yourself to unnecessary risk

Negotiating a commercial lease for the first time can be a little daunting. But like anything, it becomes easier once you’re familiar with the language and customs. We’ve outlined a list of the important factors to consider when you’re thrashing out the lease with your Landlord. It will help you to find that Sweet Spot where you both get a good deal out of the arrangement.

Negotiating a commercial lease for the first time can be a little daunting. But like anything, it becomes easier once you’re familiar with the language and customs. We’ve outlined a list of the important factors to consider when you’re thrashing out the lease with your Landlord. It will help you to find that Sweet Spot where you both get a good deal out of the arrangement.

It might seem very basic, but it is vital to get the names of the entities or “parties” correct when drafting a legal document. Stating the parties formally and accurately gives you certainty that there can be NO question about the parties’ intentions later, especially if the particulars are changed or forgotten. We look at the different types of “parties” and the correct way to record the information.

It might seem very basic, but it is vital to get the names of the entities or “parties” correct when drafting a legal document. Stating the parties formally and accurately gives you certainty that there can be NO question about the parties’ intentions later, especially if the particulars are changed or forgotten. We look at the different types of “parties” and the correct way to record the information.

Signing a retail lease is one of the most important business decisions you will make. It is therefore essential that your retail lease feature clear and explicit negotiated terms so that both parties are clear on how the lease is intended to operate. In other words you need to make sure that your lease says what you mean it to.

Signing a retail lease is one of the most important business decisions you will make. It is therefore essential that your retail lease feature clear and explicit negotiated terms so that both parties are clear on how the lease is intended to operate. In other words you need to make sure that your lease says what you mean it to.

A Security Deposit or Bond is a sum of money paid by the tenant to the Landlord to secure the obligations they have agreed to under the lease. We look at the procedures of taking and drawing on a security bond.

A Security Deposit or Bond is a sum of money paid by the tenant to the Landlord to secure the obligations they have agreed to under the lease. We look at the procedures of taking and drawing on a security bond.

For a landlord, a well worded permitted use definition allows you to maintain effective control over the premises and the way it will be used. You can make the permitted use as specific or as open as you wish.

For a landlord, a well worded permitted use definition allows you to maintain effective control over the premises and the way it will be used. You can make the permitted use as specific or as open as you wish.

The signature panel of your lease is a vital part of the agreement. Follow these guidelines to ensure you complete and sign your lease correctly.

The signature panel of your lease is a vital part of the agreement. Follow these guidelines to ensure you complete and sign your lease correctly.

When you lease a retail or commercial premises, you need to decide how you will manage the outgoings. Will they be charged as a separate amount or will they be added to the regularly monthly payment. This article helps you to determine which option you should choose.

When you lease a retail or commercial premises, you need to decide how you will manage the outgoings. Will they be charged as a separate amount or will they be added to the regularly monthly payment. This article helps you to determine which option you should choose.

Retail lease transactions are heavily regulated in Australia and in most states and territories, retail tenants have the right to a minimum 5 year lease term. There are circumstances however, where your might want to set the minimum term at less than 5 years. This article explains how this might be done.

Retail lease transactions are heavily regulated in Australia and in most states and territories, retail tenants have the right to a minimum 5 year lease term. There are circumstances however, where your might want to set the minimum term at less than 5 years. This article explains how this might be done.

Dispute Resolution Process for Commercial and Retail Leasing for each Australian state set out in easy-to-read table format.

Dispute Resolution Process for Commercial and Retail Leasing for each Australian state set out in easy-to-read table format.

It’s a situation every landlord hopes to avoid – non-payment of rent. And while you do hope it’s not going to happen to you, if it does you need to take a pro-active approach and contact your tenant in the right way at the right time. As retail leasing laws vary from state to state, we’ve put together a page that gives you the information you need.

It’s a situation every landlord hopes to avoid – non-payment of rent. And while you do hope it’s not going to happen to you, if it does you need to take a pro-active approach and contact your tenant in the right way at the right time. As retail leasing laws vary from state to state, we’ve put together a page that gives you the information you need.

Peter sent in a burning question asking if it is legal to allow a new retail tenant to occupy a shop on a month to month basis in Victoria?

Peter sent in a burning question asking if it is legal to allow a new retail tenant to occupy a shop on a month to month basis in Victoria?

A popular strategy among business owners is to purchase (or transfer) their business premises into a Self Managed Superannuation Fund (SMSF). The business property is then leased to the business entity (or individual) as the tenant. This is a great way to leverage your assets as long as all dealings between the SMSF and related parties are kept at arms length and on Commercial terms, that is, you have to get the paperwork in order.

A popular strategy among business owners is to purchase (or transfer) their business premises into a Self Managed Superannuation Fund (SMSF). The business property is then leased to the business entity (or individual) as the tenant. This is a great way to leverage your assets as long as all dealings between the SMSF and related parties are kept at arms length and on Commercial terms, that is, you have to get the paperwork in order.