It might seem obvious but it is vital that the information recorded on the signing page is accurate.

Make sure you use the appropriate signature panel for each signatory, depending on whether the signatory is a corporation or an individual.

When dealing with a company, proprietary limited company, or partnership, always request an official authentic copy of the entity’s articles of association or partnership agreement, respectively, to make sure you have the name correctly.

In some states or territories of the Commonwealth, there may be hundreds of thousands of registered business entities. It could be in New South Wales, Victoria, Queensland, etc, and the subtle differences in a business name can mean that you have made a legal arrangement that may be hard to legally enforce against the entity you thought you were actually dealing with.

Insert the specific information of names, dates, titles, etc. where required.

Delete the signature panels that are not needed.

If you require additional signature panels, simply copy and paste more into your Agreement.

Corporation signing requirements

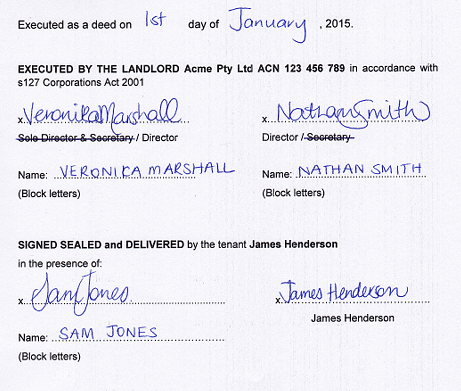

Under s 127 of the Corporations Act, the following office holders can sign on behalf of the company:-

- 2 directors of the company; or

- a director and a company secretary; or

- a sole director who is also the sole secretary.

If your tenant is a company, check that they have validly signed the lease agreement in one of the above 3 ways.

Add individual guarantors to your lease and ensure they sign in their own right, in addition to signing in their capacity as director of tenant company

If you are taking directors guarantees under the lease, it is vital that the individual directors are added as a party to the lease agreement in their own right. Insert their names at where prompted in the Schedule of your Lease as guarantors.

Additionally, each director will need to sign the agreement in his or her own right as guarantor, as well as in their capacity as director of the tenant company.

You will see guarantor signing clauses appearing after the signing clauses for the tenant and the landlord. Ensure that signing clauses for each individual guarantor are completed and validly signed before a witness.

Why take directors’ personal guarantees

It is common practice for directors of tenant companies to provide a personal guarantee in support of the company’s obligations under the lease.

A company has limited liability. A company is often used as a vehicle to limit the personal liability of the directors/shareholders. The directors and shareholders are generally not personally exposed to loss or damage (except in limited circumstances). Rather the company is a distinct legal entity that enters into the lease transaction in its own right.

If the company has a solid reputation and strong financial backing and experience, this should not present too much of an issue. However, problems arise when the company has little or no assets or access to liquid funds if the business does not go as planned. If financial difficulties arise, and you can’t recover your losses directly from the company, you may not be able to recover any losses personally from the directors unless you have a personal guarantee.

There are two generally accepted options when entering into a lease with a corporate tenant:-

- you can require the directors to personally guarantee the obligations of the company, which will enable you to recover losses directly from the directors and/or shareholders; and/or

- you can require a larger deposit amount or bank guarantee.

The benefit of a larger deposit amount is that they are faster, easier and cheaper to access should things turn sour. However, they are for a finite amount and may not cover all of your losses.

On the other hand, taking a bank guarantee may make it possible for the tenant to provide a higher deposit amount, whilst not substantially affecting the company’s cash flow.

Unless agreed otherwise, the liability imposed by a personal guarantee is unlimited and may be advantageous, particularly where the individual has a high asset base and access to funds. Personal guarantees can however, be time-consuming and costly to enforce unlike a cash deposit or bank guarantee which are relatively quick and easy to access.

Of course, the preferred position for the landlord would be to secure a large security deposit (or bank guarantee) in addition to personal guarantees from the directors of the company.