Commercial Property can be an astute investment with better returns than residential properties.

For the purposes of this page – Commercial property refers to offices, factories, warehouses or industrial property but NOT retail or shop property. If you are looking for Retail leasing information please go our Retail Contracts and Resources page.

A “lease” is a contract where one party (the lessor or landlord) grants another party (the lessee or the tenant) the right to occupy and use a certain piece of land, in exchange for money or “rent.” A commercial lease is one where the premises upon the land are used for commercial purposes.

The simple act of accepting money from someone in exchange for occupying the premises on the land is said to be a verbal lease. A verbal lease is legal, binding and it automatically gives your tenant minimum rights and obligations under the law (which may not be what you want as the Landlord).

Learn: What are the three reasons why a verbal lease can turn into a Booby Prize

There is another problem with this type of handshake arrangement – nobody knows the specifics.

For instance:

As you can see, many questions can arise. A verbal lease agreement leaves most of them unanswered which can be dangerous for both you and the tenant. That is precisely why experts nearly always recommend using a written commercial lease agreement.

A written lease agreement will clarify the fundamentals of the arrangement, protect the interests of both parties and minimise misunderstandings.

Learn more: Everything You’ll Ever Need to Know about Commercial Lease Agreements in Australia

The easiest way to draft a commercial lease agreement is to use a template customised to your situation.

A template will provide all the essential clauses necessary to document your leasing arrangement. You can consider each clause, add information as needed and tailor the document to your situation. That’s how lawyers do it!

A Lease agreement should contain all the information relevant to the transaction, such as:

Learn more: Key provisions in a commercial lease

RP Emery offer a professionally drafted Commercial Lease Agreement Template Kit for each state in Australia. It covers all the necessary provisions to protect your interests as a Landlord.

Lease Agreement Template Kit for the ACT – Australian Capital Territory

Lease Agreement Template Kit for the ACT – Australian Capital TerritoryContains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Lease Agreement Template Kit for NSW – New South Wales

Lease Agreement Template Kit for NSW – New South Wales

Contains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Lease Agreement Template Kit for the NT – Northern Territory

Lease Agreement Template Kit for the NT – Northern Territory

Contains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Lease Agreement Template Kit for QLD – Queensland

Lease Agreement Template Kit for QLD – Queensland

Contains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Lease Agreement Template Kit for SA – South Australia

Lease Agreement Template Kit for SA – South Australia

Contains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Lease Agreement Template Kit for TAS – Tasmania

Lease Agreement Template Kit for TAS – Tasmania

Contains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Lease Agreement Template Kit for VIC – Victoria

Lease Agreement Template Kit for VIC – Victoria

Contains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Lease Agreement Template Kit for WA – Western Australia

Lease Agreement Template Kit for WA – Western Australia

Contains the Lease Agreement Template, Easy-to-follow Users Guide, Agreement to Lease

Learn more: Leasing a Commercial Property – do you need a guarantor?

Learn more: Do you need to register a Commercial Lease?

Learn more: Is your Commercial lease secure?

If you own a parcel of vacant land that you’re not using, then it makes sense to rent that land to someone else. You receive income for land that’s just sitting there, and the other party can use the land to fulfil a purpose.

If you own a parcel of vacant land that you’re not using, then it makes sense to rent that land to someone else. You receive income for land that’s just sitting there, and the other party can use the land to fulfil a purpose.

This professionally drafted vacant land lease agreement allows you to document the terms of your agreement with the tenant so that both parties are legally protected. It gives you peace of mind because all the expectations are spelt out in black and white, and you will be able to rely upon it if there are any misunderstandings with the tenant during the lease term.

Sometimes the best option is not to lease a whole commercial space just for yourself. Maybe you don’t need that much room, the cost is too high or you feel reluctant to commit to a long term lease.

There are other options.

What is a Sublease Agreement?

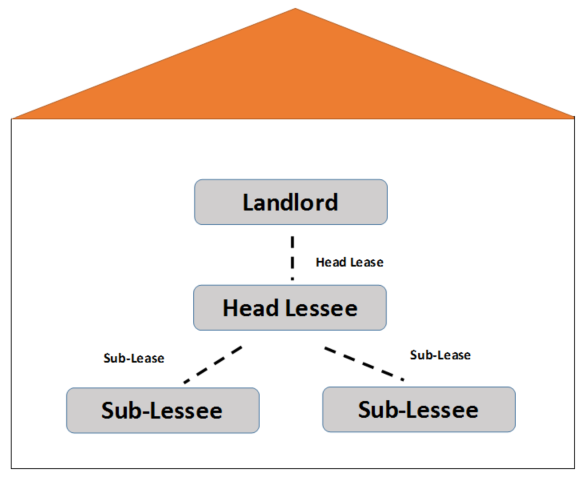

A Commercial Sublease Agreement is used to sub-let the whole, or a part of, leased premises.

It creates a legal relationship between the incoming sub-tenant and the existing tenant (head-tenant), creating certain rights and obligations between them (and not the landlord) – in short, the right to occupy a certain area, in exchange for a specified rent amount.

It is important to note that it is the existing tenant who will remain liable under the terms of the original Lease Agreement.

Commercial Sublease Agreement Template

Commercial Sublease Agreement TemplateUse this template agreement to document the obligations of the sub-tenant and head-tenant.

Learn more: The pros and cons of Subleasing a commercial premise

Learn more: How to provide an option to a sub-tenant

An Assignment of Lease Agreement (in some states referred to as a Transfer of Lease) transfers an existing tenant’s leasehold interest to the new tenant, creating rights and obligations as between the new tenant and the landlord.

An Assignment of Lease Agreement (in some states referred to as a Transfer of Lease) transfers an existing tenant’s leasehold interest to the new tenant, creating rights and obligations as between the new tenant and the landlord.

In effect, the new tenant agrees to step in and take over the existing tenant’s rights and obligations under the Lease. The new tenant becomes bound to the terms and conditions of the Lease, taking the place of the existing tenant, who is then released from it’s obligations as at the date of transfer. In this instance, a tenant who has assigned, or transferred, their leasehold interest will not be liable if the new tenant defaults.

Learn more: What’s the difference between assigning and subletting?

A licence is generally a more informal agreement than a lease. Often the licensee does not have exclusive possession of the premises – others are able to access the premises, most likely the landlord or other licensees sharing the space.

Learn more: What the difference between a lease and a licence?

Learn more: When to use a licence agreement?

Shared Office Space Licence Template

Shared Office Space Licence TemplateThis agreement is used when the “Licensor” occupies office space and they wish to rent a portion of it to another called the “Licensee.” It sets out the terms of the space rental, placing clear boundaries on the relationship. It ensures that each party understands their obligations and covers the essential issues like licence fees, bond amount, frequency, method of payment and so forth. See Shared Office licence page for full list of provisions.

Storage Space Licence Template

Storage Space Licence TemplateThis document sets out the terms of the space rental, placing clear boundaries on the relationship. It ensures that each party understands their obligations and covers the essential issues like licence fees, bond amount, frequency, method of payment and so forth. See Storage space licence page for full list of provisions.

Manufacturing Area Licence Agreement Template

Manufacturing Area Licence Agreement TemplateThis agreement is used when the “Licensor” occupies industrial space and they wish to rent a portion of it to another called the “Licensee.”

The licensee does not have exclusive use of the area or portion of the area. For example – there may be common areas like a kitchen or bathrooms.

Car Park Licence Template

Car Park Licence TemplateThis agreement sets out the rights and responsibilities of the Licensor (that’s person who grants the right use the space) and those of the licensee (the entity who will rent the space from you). You can use our car park license agreement whether you are the owner of the carpark space or have the right to use the car space under another leasing arrangement.

Learn more: Renting a Car Parking Space

This document sets out the understanding between the parties to a proposed lease as to the terms to be entered. It is common practice for the parties to enter into an informal agreement to lease often referred to as a heads of agreement or a memorandum of understanding prior to drafting the full lease agreement.

This document sets out the understanding between the parties to a proposed lease as to the terms to be entered. It is common practice for the parties to enter into an informal agreement to lease often referred to as a heads of agreement or a memorandum of understanding prior to drafting the full lease agreement.

This document is included with our retail and commercial leasing kits.

Use this agreement when the parties to a commercial lease agreement wish to alter the terms and conditions of the agreement, such as rent payments or the duration of the agreement

Use this agreement when the parties to a commercial lease agreement wish to alter the terms and conditions of the agreement, such as rent payments or the duration of the agreement

In business, it is prudent to conduct targeted enquiries such as bankruptcy and company searches on the parties you are considering dealing with so you can make sure you are not exposing yourself to unnecessary risk

In business, it is prudent to conduct targeted enquiries such as bankruptcy and company searches on the parties you are considering dealing with so you can make sure you are not exposing yourself to unnecessary risk

It might seem very basic, but it is vital to get the names of the entities or “parties” correct when drafting a legal document. Stating the parties formally and accurately gives you certainty that there can be NO question about the parties’ intentions later, especially if the particulars are changed or forgotten. We look at the different types of “parties” and the correct way to record the information.

It might seem very basic, but it is vital to get the names of the entities or “parties” correct when drafting a legal document. Stating the parties formally and accurately gives you certainty that there can be NO question about the parties’ intentions later, especially if the particulars are changed or forgotten. We look at the different types of “parties” and the correct way to record the information.

A Security Deposit or Bond is a sum of money paid by the tenant to the Landlord to secure the obligations they have agreed to under the lease. We look at the procedures of taking and drawing on a security bond.

A Security Deposit or Bond is a sum of money paid by the tenant to the Landlord to secure the obligations they have agreed to under the lease. We look at the procedures of taking and drawing on a security bond.

When negotiating a Commercial Lease it gives you greater power to understand the key provisions that will affect your bottom line. It’s not just the rent, there are a number of different clauses in the lease that contribute to the overall costs. Be aware that there are provisions that provide a little wiggle room and these often provide an opening to reducing the costs when negotiating with the Landlord.

When negotiating a Commercial Lease it gives you greater power to understand the key provisions that will affect your bottom line. It’s not just the rent, there are a number of different clauses in the lease that contribute to the overall costs. Be aware that there are provisions that provide a little wiggle room and these often provide an opening to reducing the costs when negotiating with the Landlord.

When you’re negotiating a retail lease, striking the right balance between your needs and that of your tenant can be challenging. A well worded permitted use clause balances your desire to maintain effective control over the premises and how they’ll be used against the tenant’s need for the opportunity to grow and expand their business. Here are some of the facts to consider when negotiating yours.

When you’re negotiating a retail lease, striking the right balance between your needs and that of your tenant can be challenging. A well worded permitted use clause balances your desire to maintain effective control over the premises and how they’ll be used against the tenant’s need for the opportunity to grow and expand their business. Here are some of the facts to consider when negotiating yours.

There are a variety of circumstances that might lead your tenant to ask for an assignment of the lease or to sublet the leased premises. This article outlines the steps a Landlord of a commercial property should take if your tenant asks this question.

There are a variety of circumstances that might lead your tenant to ask for an assignment of the lease or to sublet the leased premises. This article outlines the steps a Landlord of a commercial property should take if your tenant asks this question.

Negotiating a commercial lease for the first time can be a little daunting. But like anything, it becomes easier once you’re familiar with the language and customs. We’ve outlined a list of the important factors to consider when you’re thrashing out the lease with your Landlord. It will help you to find that Sweet Spot where you both get a good deal out of the arrangement.

Negotiating a commercial lease for the first time can be a little daunting. But like anything, it becomes easier once you’re familiar with the language and customs. We’ve outlined a list of the important factors to consider when you’re thrashing out the lease with your Landlord. It will help you to find that Sweet Spot where you both get a good deal out of the arrangement.

Are you signing up or thinking of signing a commercial lease? As a tenant there are a few key provisions to look out for because they have the potential to make or break your tenancy. This article explains what they are and what you should look for.

Are you signing up or thinking of signing a commercial lease? As a tenant there are a few key provisions to look out for because they have the potential to make or break your tenancy. This article explains what they are and what you should look for.

Yes, you can sublease commercial or retail premises, provided that the terms of your Lease do not prevent you from doing so. If you wish to sublet part of your space then you need to follow the correct procedure so your sublease is approved by the Landlord.

Yes, you can sublease commercial or retail premises, provided that the terms of your Lease do not prevent you from doing so. If you wish to sublet part of your space then you need to follow the correct procedure so your sublease is approved by the Landlord.

If you own a Commercial rental Property you can claim the following list of expenses as a tax deduction as long as the expenses were incurred during the period your property was rented or available for rent.

If you own a Commercial rental Property you can claim the following list of expenses as a tax deduction as long as the expenses were incurred during the period your property was rented or available for rent.

When considering the issue of outgoings, Landlords may charge separate outgoings to the tenant as they arise, or add an outgoings component onto the base rent amount. This article examines which approach might suit your circumstances.

When considering the issue of outgoings, Landlords may charge separate outgoings to the tenant as they arise, or add an outgoings component onto the base rent amount. This article examines which approach might suit your circumstances.

Dispute Resolution Process for Commercial and Retail Leasing for each Australian state set out in easy-to-read table format.

Dispute Resolution Process for Commercial and Retail Leasing for each Australian state set out in easy-to-read table format.

It is a situation landlords hope they will never experience. Their tenant has stopped paying rent and they need to take action to mitigate the damage to their bottom line. We look at what the Landlord needs to do and more importantly how they should do it

It is a situation landlords hope they will never experience. Their tenant has stopped paying rent and they need to take action to mitigate the damage to their bottom line. We look at what the Landlord needs to do and more importantly how they should do it

A recent decision of the New South Wales Civil and Administrative Tribunal (Charlie Bridge Street Pty Limited v Petrazzuolo: Petrazzuolo v Charlie Bridge Street Pty Limited [2019] NSW CATCD1) has raised some interesting issues about the right of a landlord to terminate a lease for non-payment of rent without giving notice to the tenant. The decision also found that a provision of the printed Law Society of NSW lease does not comply with section 129 of the Conveyancing Act and is therefore inoperable.

A recent decision of the New South Wales Civil and Administrative Tribunal (Charlie Bridge Street Pty Limited v Petrazzuolo: Petrazzuolo v Charlie Bridge Street Pty Limited [2019] NSW CATCD1) has raised some interesting issues about the right of a landlord to terminate a lease for non-payment of rent without giving notice to the tenant. The decision also found that a provision of the printed Law Society of NSW lease does not comply with section 129 of the Conveyancing Act and is therefore inoperable.

A popular strategy among business owners is to purchase (or transfer) their business premises into a Self Managed Superannuation Fund (SMSF). The business property is then leased to the business entity (or individual) as the tenant. This is a great way to leverage your assets as long as all dealings between the SMSF and related parties are kept at arms length and on Commercial terms, that is, you have to get the paperwork in order.

A popular strategy among business owners is to purchase (or transfer) their business premises into a Self Managed Superannuation Fund (SMSF). The business property is then leased to the business entity (or individual) as the tenant. This is a great way to leverage your assets as long as all dealings between the SMSF and related parties are kept at arms length and on Commercial terms, that is, you have to get the paperwork in order.