You might hear the term “at arms length” thrown about in relation to commercial transactions but what exactly does it mean?

The legal definition of arm’s length

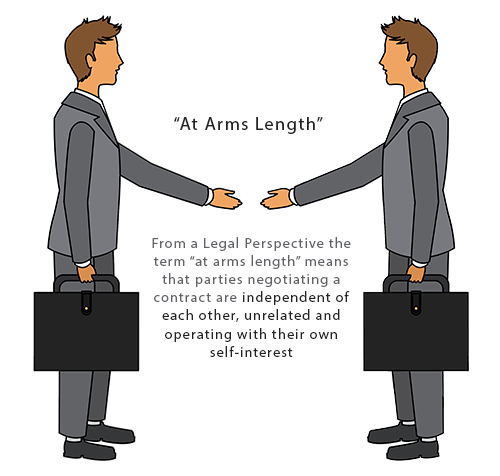

Legally, when parties are negotiating commercial transactions, there is an expectation that both parties are ‘at arm’s length’. This simply means that both parties are independent of each other, un-related and operating with their own self-interest.

What does it mean in practice?

In practice, when two parties are negotiating, there may be certain information withheld by one party that the other is not privy to. Sometimes you might not want the other party to know a specific piece of information, as it might change their negotiating stance.

However, there is no obligation for the opposing party to bring the information to the attention of the other party.1 Further, secretive conduct and the withholding of information is not necessarily considered to be ‘unconscionable conduct’.2

For example, a landlord is not required to disclose sensitive information to a tenant during contract negotiations. In the case of NB2 v P.T Ltd,3 the judge held that it is unreasonable to expect a landlord to disclose prospective tenant information to existing tenants. In this case the landlord did not disclose in lease extension negotiations for a fruit and vegetable retailer that a significant supermarket competitor would be taking up a lease nearby. The judge noted that when parties negotiate at arm’s length, there may be situations where one party does not inform the other party of something which could impact their negotiating position. This practice is not necessarily ‘unconscionable’ in a legal sense.

What does this mean for me?

If you are engaged in commercial contract negotiations you and your counterparty will be negotiating from different perspectives, will leverage different bargaining powers and will want the best outcome for your own interest.  This doesn’t mean you should be dishonest, but you should be cautious and ensure that you have any key terms documented in your agreements.

This doesn’t mean you should be dishonest, but you should be cautious and ensure that you have any key terms documented in your agreements.

What about Self-Managed Super Funds?

There is also an obligation on a Self-Managed Superannuation Fund (‘SMSF’) Trustees to negotiate as if there was no relationship between the parties i.e. with a level of independence at ‘arm’s length’.

For example, if you are a SMSF Trustee, you must record any purchases or sale of assets accurately so that they reflect the true rate of return. If you are selling property belonging to the SMSF to a family member, you should sell at market value and not significantly below. If you are leasing SMSF property, the terms must be on a commercial basis, recorded on a commercial lease and any rent paid to the SMSF must be at the market rate.

If transactions are deemed by the Australian Tax Office to be a related-party transaction (i.e. not at arm’s length), they will tax the income at the higher marginal taxation rate. In the case of Chevron Australia Holdings Pty Ltd v Commissioner of Taxation (No 4), 4 the ATO imposed a significant taxation order on Chevron to the value of $200 Million as it believed a parent company could not have transacted with a subsidiary on a loan agreement at ‘arm’s length’.

Conclusion

The concept of ‘arm’s length’ is an important principle as it upholds the integrity of contractual negotiations. However, it is important to remember that there is no obligation for either party to disclose commercial information during contract negotiations. Ensuring any key negotiated terms are documented clearly in the agreement will help prevent future issues.

References

1 Lam v Ausintel Investments Australia Pty Ltd (1990) 97 FLR 458 at 475 per Gleeson CJ.

2 Competition and Consumer Law Act (2010) Schedule 2 (‘Australian Consumer Law’).

3 NB2 Pty Ltd v P.T. Ltd [2018] NSWCA 10.

4 Chevron Australia Holdings Pty Ltd v Commissioner of Taxation (No 4) [2015] FCA 1092.

This article by Elise Nisbet

Elise Nisbet (LLB, GDLP, BCom (Hons)) is a qualified lawyer, working for a Top 50 ASX listed Company. She is an award-winning academic researcher and skilled legal writer with experience in banking and finance, corporate governance, risk management and compliance.

Elise Nisbet (LLB, GDLP, BCom (Hons)) is a qualified lawyer, working for a Top 50 ASX listed Company. She is an award-winning academic researcher and skilled legal writer with experience in banking and finance, corporate governance, risk management and compliance.

Last updated: 19 February 2020

Related Resources

Purchasing your business premises with your SMSF

A popular strategy among business owners is to purchase (or transfer) their business premises into a Self Managed Superannuation Fund (SMSF). The business property is then leased to the business entity (or individual) as the tenant. This is a great way to leverage your assets as long as all dealings between the SMSF and related parties are kept at arms length and on Commercial terms, that is, you have to get the paperwork in order.

A popular strategy among business owners is to purchase (or transfer) their business premises into a Self Managed Superannuation Fund (SMSF). The business property is then leased to the business entity (or individual) as the tenant. This is a great way to leverage your assets as long as all dealings between the SMSF and related parties are kept at arms length and on Commercial terms, that is, you have to get the paperwork in order.

How to make sure your Retail Lease says what you mean

Signing a retail lease is one of the most important business decisions you will make. It is therefore essential that your retail lease feature clear and explicit negotiated terms so that both parties are clear on how the lease is intended to operate. In other words you need to make sure that your lease says what you mean it to.

Signing a retail lease is one of the most important business decisions you will make. It is therefore essential that your retail lease feature clear and explicit negotiated terms so that both parties are clear on how the lease is intended to operate. In other words you need to make sure that your lease says what you mean it to.

Ready-to-use Retail Lease kit includes everything you need to rent your shop premises

- Professionally drafted retail lease Agreement (doc)

- Professionally Drafted Disclosure statement

- Sample disclosure statement and Retail lease

- Easy to follow help guide

- Getting Started document

- Friendly customer support