A will is a legal document which prescribes what happens to your assets after you die. A validly executed will is the best way to ensure that your family is adequately provided for and that your estate is dealt with according to your wishes.

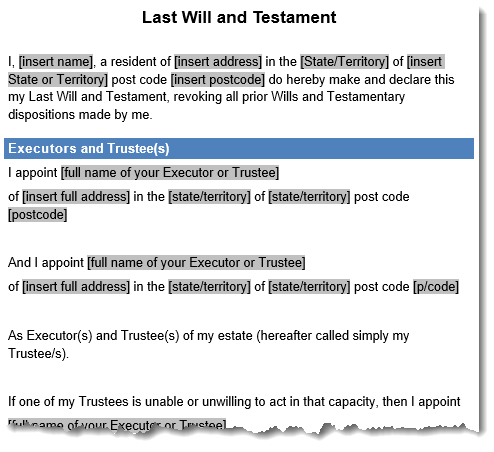

Sample excerpt from our Last Will and Testament Template kit

A will should be current, valid and clearly and explicitly outline how you wish for your estate to be distributed. You should appoint an executor (who could be a family member, your solicitor or a trusted friend) who should maintain a copy of the document.

Wills are particularly important for blended families and second marriages, as the distribution of an estate without a will is determined by the Court. In this article, we discuss 6 things that could go wrong if you do not have a will.

You will have limited say in the distribution of your assets

If you die without a will, you will be considered ‘intestate’ and a Court will determine how your assets are distributed via a pre-determined legal formula. This means that any wishes you have regarding distribution of your assets will not be followed.

For example, you may wish for your estate to be distributed equally to your spouse and children, but seek to include conditions on the distribution (e.g. that your children’s distribution is held on trust until they are 18 or under a condition that they must attain a university degree prior to distribution). Further, if you have children who are step-children to your spouse, they may not receive a distribution (can be dependent on the value of your estate and State you are in).

Succession laws generally stipulate that the hierarchy of next of kin is as follows:

- Spouse;

- Child(ren);

- Parent(s);

- Sibling(s) or their children;

- Grand parent(s);

- Auntie(s) and Uncle(s) or their children.

Most States favour spouses in the distribution of assets if you die intestate. For example, if you die without a will in NSW or TAS, 100% of the distribution of your assets will pass to your spouse.[1] If you leave no living spouse, your 100% of your assets will pass to your child(ren).

There are some variations to this hierarchy regarding distribution of assets between spouse, children and step-children which vary from state-state.[2]

If you have no living relatives and you die without a will, your assets will pass to the State.

Your children may not receive benefit of your estate

If you die without a will but leave your spouse and children only to your spouse, then the spouse takes the entire estate regardless of the value and your children may receive nothing. As outline above, there is a specified hierarchy for distribution should you die without a will. If you have children or step children, they may not be provided for according to your wishes in the distribution of your estate.

Ex-partners may have a claim over your estate

If you have a de-facto partner (more than 2 years) and an ex-spouse (separated, not divorced), the ex-spouse and the current de-facto partner may be entitled to a 50% share of the estate each.[3] Any children may receive no entitlement (but this varies state by state).

It is important to note that if you marry or subsequently re-marry, the marriage will revoke any pre-existing will. A separation or a divorce will not revoke a will.

Sometimes parties may have an existing binding financial arrangement in place, which determines the division of assets upon separation of parties. A binding financial arrangement may prohibit a spouse’s claim on your legal estate, but this will depend on the operation of a clause which whether the terms of your agreement limits the right to claim against the estate and whether agreement was validly executed.[4]

Other beneficiaries may have a claim over your estate

Your estranged siblings may have an equal claim over your estate if you do not have a living spouse, children or parents. In this case, all brothers and sisters share the estate equally, regardless of whether they are full or half siblings.

If any brother or sister died leaving children, then those children (nieces / nephews) take the share their parent would have received.

It is very difficult for your family to tend to your affairs

If you die without a will, your estate may be administered by someone you do not want or trust. The ‘Executor’ or Administrator of the estate is duly appointed under a will to deal you’re your affairs. If not appointed under a will, your family must apply for letters of administration to the Court which can be a complex process.

Increased costs

If you die without a will, your estate will be distributed according to court determination. This means that the legal costs will be paid by your estate, meaning that the amount available to beneficiaries is reduced.

It is important to foremostly have a will, but it is also critical that you review your will on a regular basis (but particularly after a significant life event). It is also recommended that you have a binding financial arrangement win place and that this arrangement is reviewed in conjunction with your will.

[1] Succession Act 2006 (NSW) s 112; Intestacy Act 2010 (Tas) s 13.

[2] Administration and Probate Act 1919 (SA) s 72G; Administration and Probate Act 1958 (Vic) s 70K; Succession Act 1981 (Qld) Schedule 2; Administration Act 1903 (WA) s 14; Administration and Probate Act 1929 (ACT) s 49B; Administration and Probate Act 1969 (NT) Schedule 6.

[3] Succession Act 2006 (NSW) s 112; Administration and Probate Act 1919 (SA) s 72H;

[4] Neil v Jacovou [2011] NSWSC 87; Hills v Chalk [2008] QCA 159. Note that NSW is the only state where a party can contract out of estate entitlement per Succession Act 2006 (NSW) s 95.

This article by Elise Nisbet

Elise Nisbet (LLB, GDLP, BCom (Hons)) is a qualified lawyer, working for a Top 50 ASX listed Company. She is an award-winning academic researcher and skilled legal writer with experience in banking and finance, corporate governance, risk management and compliance.

Elise Nisbet (LLB, GDLP, BCom (Hons)) is a qualified lawyer, working for a Top 50 ASX listed Company. She is an award-winning academic researcher and skilled legal writer with experience in banking and finance, corporate governance, risk management and compliance.

Last updated: 23 June 2020

Resources

Last Will and Testament Kit

Each year thousands people die without leaving a Will and all too often this creates more worries, expense and sometimes hardship for the family of the deceased at a time of bereavement.

Each year thousands people die without leaving a Will and all too often this creates more worries, expense and sometimes hardship for the family of the deceased at a time of bereavement.

Making a will is not all that difficult, it just takes a little planning and time. Don’t put it off- grab a will kit today and get started. Your loved ones will thank you for it!

Financial Agreements

A Financial Agreement is a document that allows you to choose how to divide property and financial resources in the event of a relationship breakdown.

Where to store your Will so your loved ones can find it

So, you’re organised, you’re diligent – you make a Will and have all your affairs nicely in order. Tick, tick and tick. But all this comes to nothing if your loved ones don’t know where you have stored your Will.

So, you’re organised, you’re diligent – you make a Will and have all your affairs nicely in order. Tick, tick and tick. But all this comes to nothing if your loved ones don’t know where you have stored your Will.

Burning Question: About Executors

Choosing an executor to administer your last Will is an important task. We’ve compiled a list of common questions and answers to help you choose an executor and prepare them for the jobs they will need to do.

Choosing an executor to administer your last Will is an important task. We’ve compiled a list of common questions and answers to help you choose an executor and prepare them for the jobs they will need to do.