There have been a few articles in the media lately talking about the rise of the “Bank of Mum and Dad” and how it’s affecting the rates of home ownership, rising real estate prices and the gap between the haves and have-nots.

According to this article, the economic downside to the bank of mum and dad, the number of parents helping their kids into their first home has risen to about half of all first time home buyers, an increase from just five percent six years ago, according to a report from Digital Finance Analytics.

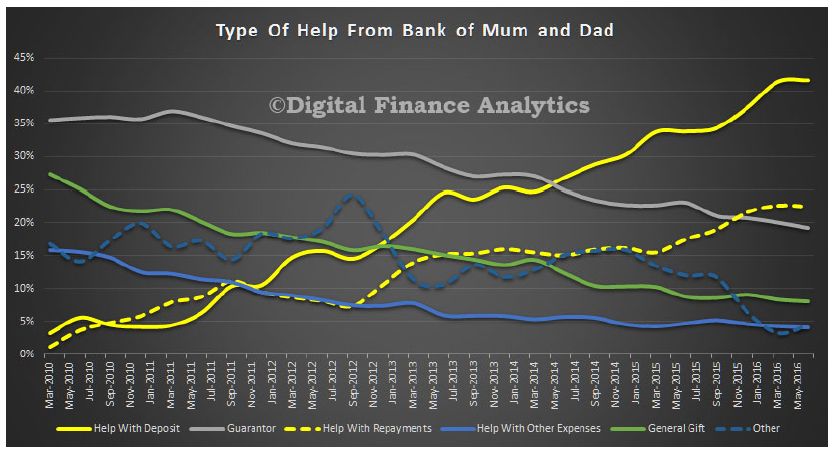

This seems like a very large rise and if you view their graph below, it may just be a matter of semantics. The rates for parents helping with deposit have risen markedly but other forms of parental assistance such as going guarantor, general gifts, helping with other expenses have all fallen.

It’s not a new thing

It makes sense that young homebuyers with access to cash from mum and dad, enjoy greater levels of home ownership and can generally afford to buy a more expensive house.

But the bank of mum and dad is not a new thing. The human species has a strong instinctive need to nurture and care for its offspring. We want to see our children happy, secure and successful so that they can go forth and reproduce.

My parents helped me and my siblings get a start in our first homes. For my siblings it was a gift/loan and for me it was part of an inheritance. Even though I received this boon in my late teens, there was no thought of travelling or wild parties, it was going straight into a house. I was from migrant stock and the virtues of owning your home was drummed into me from a very young age.

My partner and his siblings got a helping hand from their parents or their partner’s parents, and I bet if I was to undertake a random quiz of people my age, the rates of parental assistance would be pretty high, especially if they grew up in middle class Australia.

The rise of First Time Home Buyers going straight into the Investment Market

What may be a little different these days is the growing trend for first time home buyers to go straight into the investment market. Part of this is fuelled by the fact that property prices are so high where they want to live, that they invest in a cheaper area instead.

But it could also be that young house buyers are “being infected by the notion that property is about wealth building, rather than somewhere to live… and are very fearful of missing out, and that delaying potential entry into the market will simply make it less affordable later.”[1]

Research shows that this fear feeds into the housing bubble and contributes to ever rising property prices. It’s a vicious cycle, and some, like the Australian Housing and Urban Research Institute, are troubled by the trend that “there is a growing risk that people without access to a cashed-up bank of mum and dad will be left behind.”[2]

What’s the solution?

“The economists say policies to boost home ownership should specifically target groups that are unlikely to receive parental gifts and bequests. Another option is to allow more people access to the bank of mum and dad by making it easier for older generations to “unlock” some of their property wealth to help their children buy a home.”[2]

Traditionally “unlocking” your property wealth meant that mum and dad would put their financial future at risk by securing the child’s loan against their family home.

BUT there is another way that sidesteps the need for mum and dad to sacrifice their own security.

This new concept enables first home buyers to get a foothold on the property ladder now, by only purchasing a portion of the property with the goal of scaling up to full home ownership within 3 years.

It allows parents who have the financial capability to help their children get off the rental cycle and buy a home, without risking their family home.