Separating from your partner can be stressful and expensive. Fortunately, you can take many of your first steps without without involving combative lawyers.

To begin:

- gather essential information;

- understand your rights and options;

- explore potential solutions to disputes; and

- seek support from friends, family, or counselling services.

If you know how you want to divide your property after separation, creating your own separation agreement before involving lawyers can significantly reduce your legal fees. Learn more about Using a Separation Agreement Template in Australia

What Is a Separation Agreement?

A separation agreement is a financial agreement between couples who are separating and wish to divide their property.

In Australia, the only form of the agreement accepted by the Family Law Act is a Binding Financial Agreement (BFA).

A binding financial agreement includes a comprehensive list of assets and liabilities, along with instructions on how to divide them. When conducting your research, ensure that any reference to a “separation agreement” is indeed referring to a Binding Financial Agreement, otherwise the product may not be suitable under Australian law.

Am I Allowed to Use a DIY Separation Template?

In Australia, there is nothing wrong with using a DIY template to draft your separation agreement as long as you obtain the required legal advice before you sign the document.

The most important thing is ensuring the template covers everything necessary for the eventual contract to comply with the Family Law Act. For this reason, it is essential that you source the template from somewhere trustworthy and only use a template designed for the Australian legal system. See How Do I Get a Separation Agreement in Australia?

What Are the Things I Need in a Separation Agreement?

A separation agreement can be lengthy due to the various sections that require detailed and specific information.

Regardless of whether the agreement is for married, divorced, or de facto couples, it typically contains the following sections:

- An introduction identifying both parties to the contract;

- The Recitals give the reader an understanding about the relationship before, during, and after the breakdown.

- The Assets and Liabilities Schedules list the property owned singularly and jointly by the parties.

- Instructions on who will receive each asset and liability, as well as processes such as how property will be transferred.

- Arrangements in relation to superannuation.

- Spousal maintenance clauses, even if you decide that maintenance will not occur.

- Other clauses relevant to ensure the contract complies with Australian law.

To ensure the financial agreement’s binding nature, two legal practitioner’s certificates must be attached as evidence that both parties received legal advice about the draft before signing it.

The separation agreement includes a signature panel, signed only after both parties have received legal advice and agree to the final terms. To witness the signatures, a third party, such as a Justice of the Peace (JP), is recommended.

What Are Recitals?

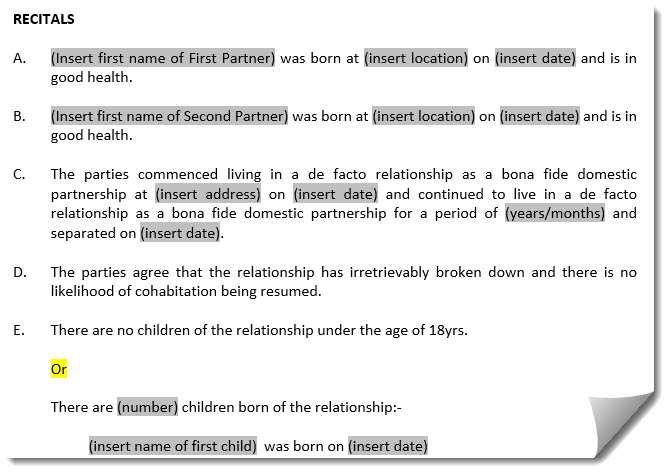

Recitals in a separation agreement are sections that provide the reader with pertinent facts about the relationship before, during, and after the breakdown.

These facts may include information about the couple’s history, duration of the relationship, living arrangements, children, financial contributions, shared assets, and any significant events that occurred during the relationship. By outlining these details, the agreement aims to provide context and clarity for the division of property and the financial arrangements post-separation.

A separation agreement template is helpful in understanding relevant facts to include in the recitals section. Common facts typically found in the agreement’s recitals are:

- Dates when the relationship started, the marriage began, and the separation occurred;

- Details about children, including names, dates of birth, references to current care arrangements and child support;

- Any external factors impacting the agreement, such as bankruptcy, creditors, and civil or criminal matters;

- Declarations of each party’s current employment status and regular income, including wages, government payments, dividends, or inheritance payments;

- References to specific sections of the Family Law Act.

Sample of recitals from RP Emery’s De Facto Separation Agreement template

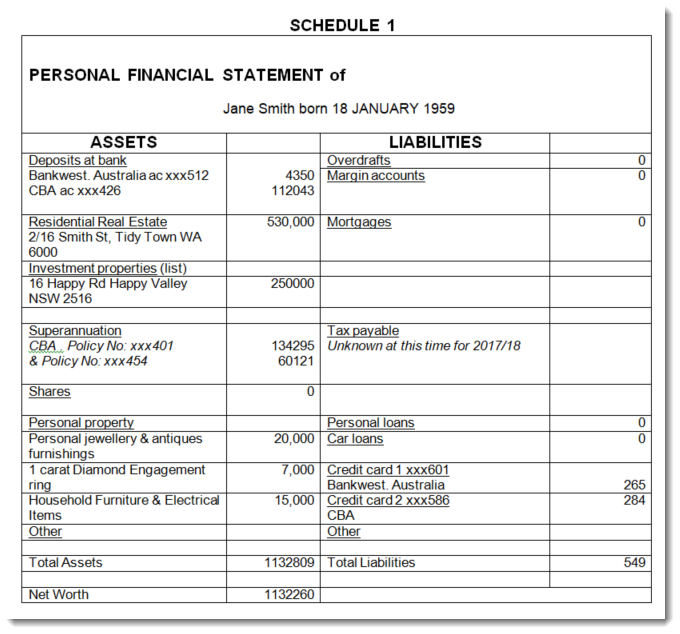

What Does an Assets and Liabilities Schedule Contain?

An assets and liabilities statement in a separation agreement is a comprehensive listing of all the assets and debts that both parties possess at the time of making the agreement. It outlines the ownership and value of assets, such as real estate, vehicles, bank accounts, investments, businesses, and personal belongings. Additionally, it includes details of debts and liabilities, such as mortgages, loans, credit card debts, and other financial obligations.

The assets and liabilities statement is crucial for the fair and equitable division of property during a separation or divorce. It provides a clear overview of the couple’s financial situation, helping both parties and legal advisors make informed decisions regarding the distribution of assets and liabilities in the separation agreement.

The Family Law Act of Australia treats any intentional omission or false statement in a Binding Financial Agreement (BFA) as a form of fraud. If a party to the agreement fails to disclose a assets or liabilities belonging to a party, the court may set the agreement aside, rendering it invalid. Additionally, the party who intentionally concealed the asset or liability may face legal repercussions for non-disclosure of a material matter. Full and honest disclosure of all assets and liabilities is crucial for the validity and enforceability of a BFA under the Family Law Act.

Sample assets and liabilities schedule – you only need to mention items of major value. This isn’t a process of haggling over everything you own.

How Can I Divide Property and Assets?

When de facto or married couples decide to separate, they have two options for dividing property and debts. They can either allow the court to make the decision on the division, or they can choose to make the decision themselves through mutual agreement.

If you would rather take control of your own destiny, you can choose to make a binding financial agreement, which is simply a private contract between you and your ex-spouse.

Your agreement must include detailed statements of your current assets and liabilities or what we call ‘the property pool’.

Your binding financial agreement will cover the division of each asset or liability in your property pool, including:

- Deciding the fate of the family home, whether it will be sold, or one party will buy out the other;

- Determining how proceeds from a sale will be divided or how much one party must pay the other;

- Addressing the splitting of superannuation interests or retaining individual super entitlements. For superannuation splitting, a Superannuation Splitting provisions must be included in your agreement;

- Allocating other properties like cars, furniture, shareholdings, and bank accounts;

- Deciding if one party will provide spousal maintenance to the other for a limited period.

What Are Spousal Maintenance Clauses?

Spousal maintenance payments are commonly arranged during separation. These are not to be confused with child support payments or agreements. Including detailed provisions for spousal maintenance within a separation agreement is crucial.

A recommended approach is to follow the process that the Family Court would use to determine maintenance orders based on Section 75 of the Family Law Act.

Do I Need a Legal Review?

Using a DIY separation agreement template is an efficient and helpful way to draft your contract. However, to ensure your agreement is binding under Australian law, both parties must still receive independent legal advice before signing the agreement.

RP Emery’s legal review service is an all-inclusive service that ensure that you have;

- followed all the instructions correctly;

- included essential information and retained vital clauses;

- accurately identified the asset pool; and

- that the agreement accurately reflects your wishes.

The legal review service ensures your lawyer can work through your agreement quickly and efficiently, reducing the time spent finalising your matter, saving you thousands of dollars!

Why Not Use a Lawyer Instead?

It might be tempting to cut off communication with your ex-partner completely and rely on lawyers to negotiate on your behalf. However, using lawyers as intermediaries often leads to an escalation of tensions between the parties, because it is easier to hide behind your lawyer while they exchange curt emails, rather than negotiating directly with each other.

More often than not, this approach leads directly to the steps of the family court and tens of thousands of dollars in legal fees.

On average, an Australian family law practitioner bills at around $400 to $700 per hour, encompassing meetings, their off-meeting work, emails, phone calls, and remember meter is always ticking.

Using a DIY separation agreement template before engaging a lawyer is an effect way to reduce a lawyer’s time spent on your matter and has the potential to save you literally thousands of dollars.

I Found Free Separation Forms. Will They Work?

A casual online search will take you to overseas websites promising you free printable separation papers you can use to create a financial agreement. These organisations often claim their documents are valid in Australia, but they usually don’t fulfill those promises and neglect to emphasize the essential requirement of seeking legal advice for the agreement to become legally binding.

Should a conflict arise, and these agreements come under scrutiny by the Family Court, there’s a high probability they will be set aside. This can result in expensive court proceedings that could have been prevented by using a more reliable template.

To craft a legally binding financial agreement that will comply with Australian family law, you should begin with a dedicated template. RP Emery’s templates are drafted by Australian lawyers experienced in what the court will look for if a dispute arises. They also come with detailed guides about how to complete the template correctly and a sample agreement which helps you appreciate the language expected.

Remembering of course that before your agreement becomes binding you must receive proper legal advice before you sign it, and any respectable lawyer will be able to spot a document that is unfit for use under Australian Family Law.

Do I Need to Divorce Before Creating a Separation Agreement?

No, it’s not necessary to get a divorce before creating a separation agreement. You can create a section 90C binding financial agreement to settle property matters at any time after separation. This agreement should be completed before finalising divorce proceedings. Even if you are already divorced, you can still establish an agreement under section 90D of the Family Law Act to settle property matters.

Can I Use a Separation Agreement as a De Facto Couple?

Absolutely, de facto couples have the option to establish a section 90UD binding financial agreement for property settlement following separation. These agreements mirror separation agreements for married couples and address the same issues. This is because de facto couples who have lived in the relationship for a minimum of two years possess the same rights under the Family Law Act as married couples.