It’s no secret that positive cash flow is the life blood of any business.

Few people enjoy chasing valued customers for unpaid accounts, but to keep the cash flowing through your business it’s crucial to stay on top of your outstanding debtors.

The need for follow up correspondence cannot be stressed enough when it comes to chasing money. By following the rules and etiquette of debt recovery you will enjoy greater success and less stress.

So let’s start at the point where the first invoice and statement have not been paid. You should send the invoice again with a friendly reminder letter as per the template below if the first invoice remains unpaid.

FIRST REMINDER LETTER – written on your company letterhead.

Any region highlighted like this is an EDITABLE region and needs to be edited with your pertinent details.

Date

[debtor’s name & address]

Dear [poor payer],

Re: OUTSTANDING ACCOUNT

We are concerned that your account with us is overdue.

The current balance of your account is $[insert amount]

We enclose copies of our invoices relating to that account.

We draw to your attention that the goods were supplied to you on the [date]. Our terms of trade are that goods are to be paid in full within seven (7) days of delivery.

If there is any difficulty with the account will you please discuss this with us as soon as possible. Otherwise, we shall expect payment of the above sum within seven (7) days of the date of this letter.

Yours faithfully,

[Your name]

So what happens if you receive no response within 7 days

Make the phone calls and remember to remain calm and confident at all times. Make sure you have all the information about the debt on hand when you make the call or approach the customer face to face if they happen to be close by.

Don’t get personal, unjustified threats or intimidation tactics are contrary to law and can work against you if legal proceedings are commenced. Maintain a professional approach, no matter how badly done by you may feel.

When reminder notices and polite calls fail to achieve the desired response a ‘Letter of Demand’ can render positive results.

A Letter of Demand serves two purposes.

- It sends a clear signal to the debtor that you are prepared to start legal proceeding unless the debt is paid.

- It provides written evidence of your claim and your attempts to settle the matter, should you need to go to court.

You should list and attach any relevant documents such as invoices, contracts, your terms of trade, and so forth to the letter of demand. This helps the debtor identify the transaction and their liability to pay.

Once you have all the documentation together, make sure you copy it for your records and then send the letter of demand to the debtor via registered post or fax. You need to send the letter in a way that is trackable so you can confirm that the debtor has in fact received the letter.

It is important to send only one letter of demand to the debtor and don’t send one at all if you are not serious about your threat to initiate legal action otherwise the debtor may simply call your bluff.

When sending a letter of demand, it is important to follow the protocols set down by the Trade Practices Act 1974 (Cth) and other legislation. You should avoid:

- Harassing the Debtor. Debt recovery guidelines include appropriate times to contact a debtor, privacy obligations owed to the debtor and provision of information and documents that may be requested. The debtor has the right to complain about behaviours that contravene their rights to particular government agencies and the police.

- Sending a letter which is designed to look like a court document because this is illegal.

Be clear in what you are asking for and outline the further action you will employ if the bill is not paid.

LETTER OF DEMAND

[date]

[debtor’s name & address]

Dear Sir/Madam [or name of the person if known],

I am writing concerning the amount of $[amount] which was due to be paid on [date] and remains outstanding despite my requests for payment. This amount relates to:

{Include whatever is appropriate, eg

* goods supplied to you by me at your request, and being [insert a brief description of the goods and any relevant dates]

or

* services provided to you by me at your request, and being [insert a brief description of the type of service and any relevant details]

or

* monies due to me pursuant to the terms of our contract dated [date] and being for [insert a brief description] }

I enclose {attach documents appropriate to identify the amount owing, e.g. a copy of my original invoice dated [date] OR a copy of our contract }.

I demand that payment of the full amount be paid to me at the address stated below within [no. of days usually 7 or 14 days] days from the date of this letter.

[OPTIONAL: ]

Alternatively, and without prejudice to my rights for full recovery of the debt, I am prepared to: [include whatever is appropriate, eg

* accept the amount of $[a lesser sum] as full and final settlement of the debt if paid within 7 days [or other appropriate period] from the date of this letter.

* accept instalments of $[amount] per week/month until the debt is fully paid, the first instalment to be paid on [date] into [specify address/bank account details] and thereafter on the first working day of every week/month until the debt is fully paid.]

If this matter is not resolved by the time specified above, I reserve the right to commence legal proceedings to recover the debt without further notice to you and this letter may be tendered in court as evidence of your failure to pay.

Yours sincerely

[your name, address and other contact details]

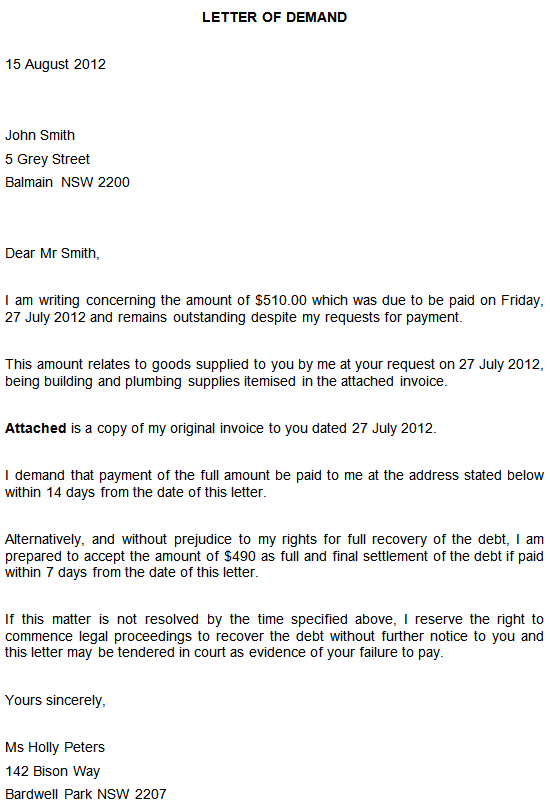

Sample of Letter of Demand Completed

Where all attempts at debt collection have proved unsuccessful, moving on to litigation and court proceedings may be your final resort. Often the issue of proceedings is enough to convince a debtor to pay.