Call Us -

1800 608 088

The best way to avoid a Division 7A dividend is to create loan agreements before lending to associates.

To implement a loan agreement:

1. Put the loan in writing before the company’s lodgement date. (Lodgement date is the date on which the company tax return is lodged, or the due date for lodgement – whichever occurs first)

2. Ensure the rate of interest is equal to or above the Indicator Lending Rates

3. Make sure the loan doesn’t exceed the maximum term of either:

You also need to ensure the shareholder or associate makes minimum yearly repayments. If they fail to do so, the amount that isn’t repaid will be treated as a dividend in the income year in which it wasn’t paid.

Choose from these Four options

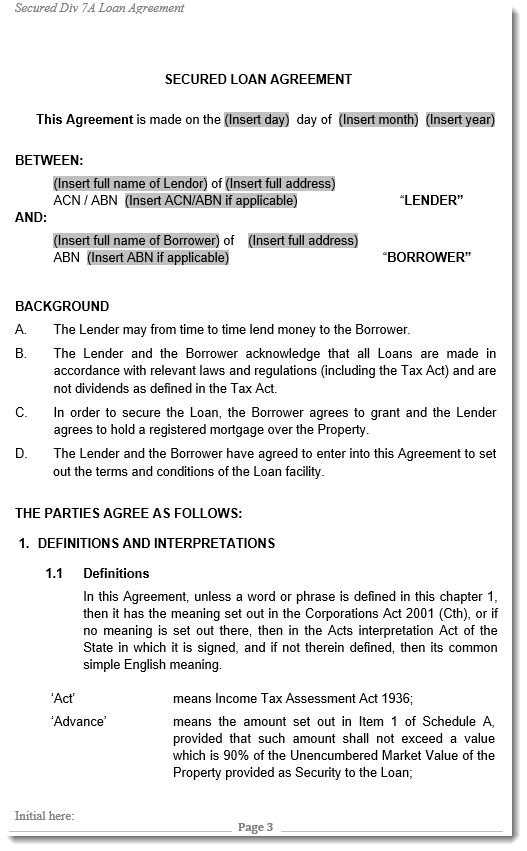

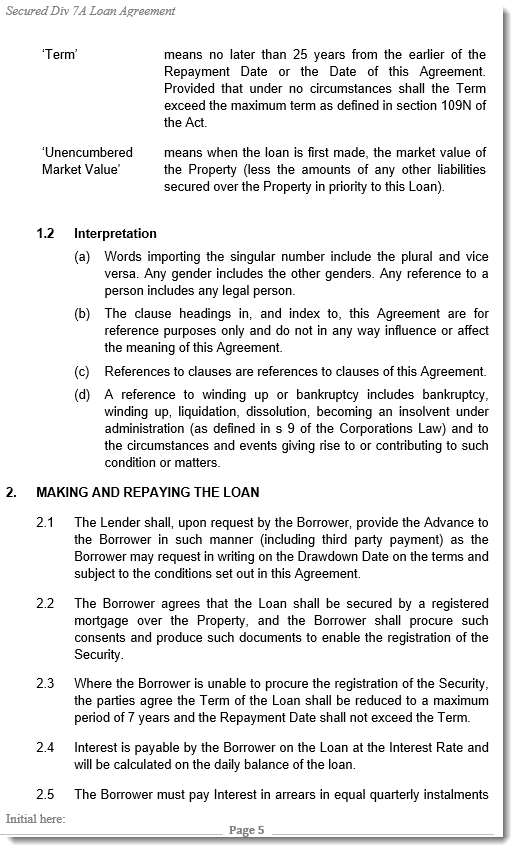

Our Division 7A Company Loan Agreement complies with the ATO’s requirements and allows you to document your loan correctly. It saves you time and gives you a cost effective way to meet your obligations.

It is available for immediate download as Microsoft Word document which makes it easy to edit. In addition it can be used as often as you need.

This table summarises the differences or check out our article Tax Facts you need to know – loans, dividends and Division 7a.

| Type of Agreement | Loan Term | Secured/Unsecured | Use Case | Flexibility |

|---|---|---|---|---|

| Secured Division 7A Loan | Up to 25 years (secured by real estate) | Secured | Long-term lending needs with collateral | Fixed loan amount, no redraws |

| Unsecured Division 7A Loan | Up to 7 years | Unsecured | Shorter-term loans, no collateral required | Fixed loan amount, no redraws |

| Line of Credit (LoC) | Up to 25 years (secured), 7 years (unsecured) | Secured or Unsecured | Flexible access to funds; ongoing borrowing | Draw, repay, and redraw up to the credit limit |

You can purchase and download this Division 7A Loan Agreement Templates safely using our fully secured ecommerce system.

Choose from these Four options

If for any reason you are not completely satisfied with your purchase or our service, please phone our office on 1800 608 088 within seven (7) days of purchase and we will rectify the situation, issue a refund, or offer a credit towards future purchases.