A Binding Financial Agreement, is a simple and convenient way to formalise the end of a marriage or a de facto relationship, at least from a financial perspective. It allows a couple to document what they think is a fair and reasonable property settlement instead of leaving that decision up to the courts.

It’s not uncommon for separating couple to postpone completing a financial settlement until the time comes when they want to buy another property or transfer property. Sometimes they are well into the loan application process when they find out that they will need proof of property settlement before the financial institution will approve the loan.

This realisation can be quite distressing especially if they have already started the purchase process for a new property and suddenly find themselves under very real and very stressful time constraints.

As the broker, you may find yourself in the position of putting time and effort into an application that will fail because of the lack of settlement proof.

We’re going to show you how you can help a client who needs to complete a property settlement.

But first lets look at the alternatives

Consent Orders

Getting Consent orders can be onerous, time consuming, expensive and uncertain. You can either engage a lawyer to fill out the paperwork or you can do it yourself using the Consent Orders Kit. The kit consists of instructions and a 25 page form that asks questions – many, many questions. You complete the form, supply the requested document and then submit it to the court and wait for their approval. This can take months.

Getting a traditional Binding Financial Agreement

Party A usually engages a lawyer to draft the agreement. The lawyer drafts the agreement and then gives it to Party B, who gives it to their lawyer. Party B’s lawyer may or may not agree with the draft and may request or make changes before sending it back to Party A.

How many times the agreement goes back and forth between the parties depends on how well the parties agree and whether they’re feeling combative.

How much it costs depends on how much time it takes and the value of the assets involved in the settlement. An average agreement can cost anywhere from $3000 – $10000.

The Peaceful Path to Settlement

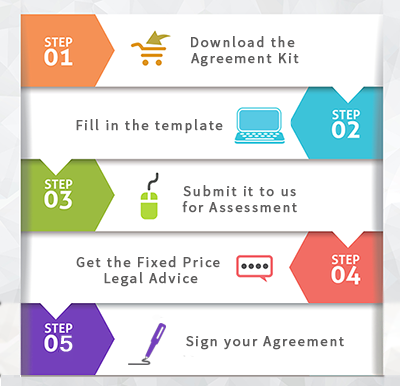

Our system uses a Financial Agreement but it’s different to the traditional method described above. There are two important parts to making a financial agreement and 5 steps on the Peaceful Path to make it happen.

- Completing the Agreement (just to get the ball rolling)

- Getting the Required Legal Advice (use our fixed price Legal Review Package)

We can show you how your clients can complete their agreement and get the legal advice for just $1987* for both parties – without stress, fuss or engaging combative lawyers.

Now let’s take a look at the 5 steps to make it happen.

The couple downloads a Separation Agreement (Financial Agreement) Kit along with the instruction and samples at a cost of . They complete the draft agreement and submit it to us for assessment. We check over their draft to make sure it’s been completed properly and that is ready to go to the lawyers.

The couple buys the legal advice (in most its only for both parties), they speak with their lawyer and obtain the necessary Certificate of Legal Advice. This advice is what makes the financial agreement legally binding.

About the Legal Advice

Under section 90G for married couples, or section 90UJ for de facto couples, parties to a financial agreement must receive independent legal advice before they execute their agreement. Independent meaning each party cannot use the same lawyer.

This is to ensure that the parties understand:

a) the advantages and disadvantages of making the agreement; and

b) what rights they give up, including the right to have a court decide on matters that are dealt with in the agreement.

So by getting proper legal advice, independent of the other party, the Act makes it near impossible for either party to argue that they didn’t know what they were signing. The lawyers will also make inquiry that the parties are entering the agreement of their own free will and that neither is under pressure or duress to sign the agreement.

Our Property settlement kit deals with all the usual issues your clients you may face when dividing financial resources, such as ownership of real estate, personal property (cars, furniture, etc), superannuation entitlements, shares, debt, spousal maintenance etc.